The responsibilities that come with federal tax obligations might sometimes feel overwhelming, but understanding them is crucial for your financial well-being. Every April, as you gather your documents and receipts, you may feel a mix of anxiety and hope. You’re not alone in this journey; millions across the United States share your commitment to fulfilling these obligations. Federal taxes play a vital role in funding public goods and services, from education to infrastructure. Knowing how to navigate your federal income tax requirements can lead to refunds that may bolster your savings or help pay off debt1. It’s essential to file your tax returns accurately and on time to avoid penalties. This is not just an administrative task; it’s an opportunity to contribute to the society that supports you. For comprehensive guidelines, don’t hesitate to refer to IRS resources on federal tax obligations.

Key Takeaways

- Understanding your federal tax obligations is essential for financial stability.

- Federal taxes fund important public services that benefit everyone.

- Filing your federal income tax return accurately can lead to potential refunds.

- Timely tax filing is crucial to avoid penalties.

- IRS resources provide valuable information for navigating federal tax requirements.

What is Federal Tax?

Federal tax refers to the financial charges imposed by the federal government on individuals and businesses. Understanding the definition of federal tax is crucial for effective financial planning. These taxes serve various purposes, including funding government programs and services that benefit the public.

Definition of Federal Tax

The term federal tax encompasses various forms of taxation applied by the U.S. government. Income tax stands out as the most prevalent form of federal tax, impacting all those who earn income, whether individuals or businesses2. This broad category includes several types, each designed to address different aspects of income and transactions.

Types of Federal Taxes

There are several types of federal taxes that taxpayers should be aware of:

- Income Tax: A progressive tax that applies to wages, salaries, and investment earnings. Tax rates for federal income tax range from 10% to 37% depending on filer’s income bracket3.

- Payroll Tax: This mandatory contribution funds Social Security and Medicare, with a total rate of 15.3% split between employers and employees3. Independent contractors pay the entire 15.3% FICA tax themselves3.

- Capital Gains Tax: Imposed on the profit from the sale of assets or investments. The rate varies based on income levels and the length of time the asset was held.

Being knowledgeable about your federal tax obligations allows you to prepare adequately for tax payments, understand deductions, and take advantage of credits available to you. This awareness aids in ensuring compliance and optimizing financial outcomes.

Who Needs to Pay Federal Taxes?

Understanding who is required to pay federal taxes is crucial for ensuring compliance with tax obligations. Most U.S. residents and citizens are liable for federal income tax on earnings above certain thresholds. These income tax requirements vary depending on filing status and age, creating a set of guidelines that taxpayers must follow.

Income Tax Requirements

For tax year 2022, the filing threshold for a single individual under 65 is $12,950, while for those 65 and Older, the threshold is $14,7004. Head of household taxpayers under 65 have a filing threshold of $19,400, which increases to $21,150 for those 65 or older4. Married couples filing jointly must file a return if both spouses are under 65 and their gross income is at least $25,900. If either spouse is 65 or older, the threshold is $27,300 and increases to $28,700 if both spouses are 65 or older4. Qualifying surviving spouses follow similar thresholds with $25,900 if under 65 and $27,300 if 65 or older4. Self-employed individuals with net earnings of $400 or more are required to file an annual return and pay estimated taxes quarterly4.

Other Tax Obligations for Businesses

Business owners are not exempt from business tax obligations. They must comply with various tax laws and regulations. According to the Sixteenth Amendment to the Constitution, Congress requires individuals and businesses to pay income taxes without apportionment among the states5. Section 6702 of the Internal Revenue Code allows the IRS to impose steep penalties against individuals who submit frivolous tax returns5. Courts typically reject arguments against these requirements, emphasizing the importance of adhering to tax laws5. Accurately reporting income is essential for self-employed taxpayers as it helps determine future Social Security benefits4. Since taxpayers have various options for deductions and credits, filing accurately can lead to significant financial savings while ensuring compliance with federal regulations5.

How Federal Tax is Collected

Understanding the mechanisms behind federal tax collection is crucial for both employed individuals and the self-employed. The methods of tax collection ensure that federal programs are funded effectively, impacting our economy directly.

Withholding Taxes from Your Salary

For most employees, federal taxes are collected through tax withholding. Employers take a portion of your paycheck to meet federal tax obligations before you even see your earnings. This system helps individuals avoid a large tax bill at the end of the year. In 2020, taxes collected by federal, state, and local governments in the United States amounted to 25.5% of GDP, which was below the OECD average of 33.5% of GDP6. Payroll taxes, which can reach up to a combined rate of 15.3%, are also deducted from wages, covering Social Security and Medicare6.

How Self-Employed Individuals Pay Taxes

If you are self-employed, navigating self-employed taxes requires understanding your estimated tax obligations. Unlike employees, you must make quarterly payments to cover both income tax and self-employment taxes. This necessity to pay estimated taxes ensures you do not owe an overwhelming amount come tax season. Federal revenue is commonly compared to GDP to provide insight into the size of government earnings relative to the country’s economic output6. Tax responsibilities for self-employed individuals can vary significantly, influencing overall financial planning for those who operate their own businesses.

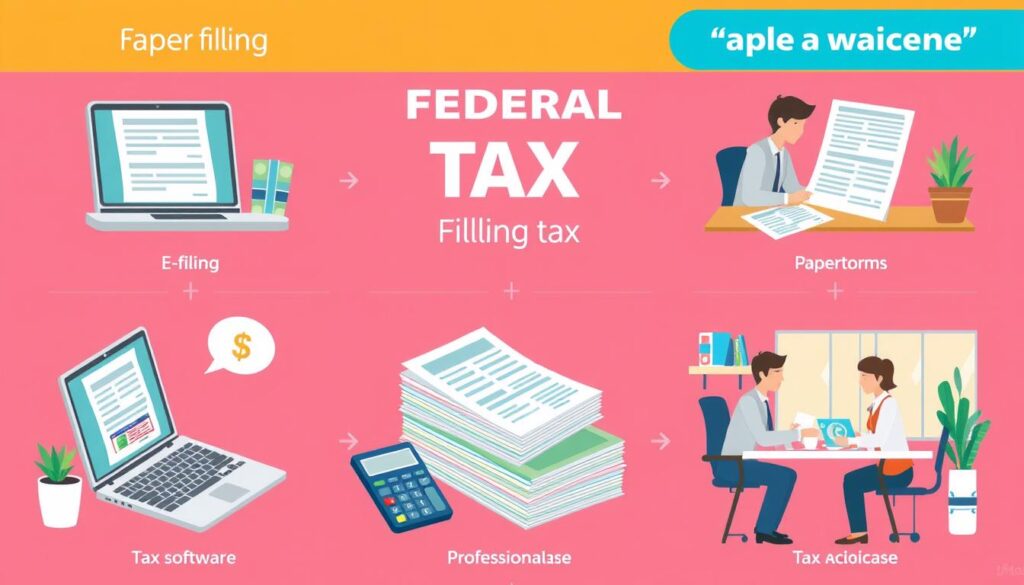

Your Federal Tax Filing Options

When it comes to filing your federal taxes, you have multiple options available to you, ensuring that you can choose the method that best suits your needs. Understanding the differences between filing online and submitting paper tax returns is key to making an informed decision.

Filing Online vs. Paper Returns

Online tax filing has gained popularity due to its speed and convenience. Taxpayers with an Adjusted Gross Income (AGI) of $79,000 or less qualify for free federal tax return preparation and filing through Guided Tax Software under the IRS Free File Program7. For those with an income above this threshold, Free File Fillable Forms offer a way to prepare and file taxes online at no cost7. E-filing generally allows for quicker refunds, especially when opting for direct deposit. Additionally, the IRS Free File program includes a partnership with leading tax preparation software companies to ensure efficiency and security7.

Using Tax Preparation Software

Utilizing tax preparation software can simplify the filing process for individuals unfamiliar with the tax code. These programs guide you step-by-step, helping you gather the necessary documents such as W-2s and 1099 forms. It’s crucial to remember that you must sign and validate your electronic tax return using either last year’s AGI or a self-select signature personal identification number7. Free self-preparation services are also available for those with incomes up to $73,000 through the IRS Free File program8.

Key Deadlines for Federal Taxes

Understanding federal tax deadlines is crucial for maintaining compliance and avoiding unnecessary late filing penalties. Each tax year has specific dates that taxpayers should keep in mind to ensure they file their returns accurately and on time.

Important Dates to Remember

For 2025, the due date for individual income tax returns falls on April 15, with extensions possible until October 159. An extension can give you additional time, but it’s essential to complete any payments owed to avoid interest. Other important dates include:

- January 31: Employers must furnish W-2 forms to employees.

- April 15: Deadline for contributions to HSAs and IRAs for the 2024 tax year9.

- April 15: Due date for first quarter estimated tax payments and filing of federal tax returns9.

- June 16: Estimated taxes for the second quarter are due and Americans living abroad must file9.

- September 15: Estimated taxes for the third quarter are due.

- January 15, 2025: Due date for fourth quarter estimated tax payments10.

Penalties for Late Filing

Failing to observe these federal tax deadlines can lead to significant late filing penalties. Those who miss the filing deadline typically face fines and accrued interest. The IRS stresses that penalties can escalate depending on how long the payment remains overdue11. For example:

| Days Late | Penalty Rate |

|---|---|

| 1 to 5 days | 5% of the unpaid tax |

| 6 to 15 days | 10% of the unpaid tax |

| 16 days or more | 15% of the unpaid tax |

Being aware of tax filing dates and understanding the implications of late filings can save you both time and money down the road. The importance of adhering to these deadlines cannot be overstated, as they are key to a stress-free tax process.

Stay informed to avoid the pitfalls associated with missed deadlines and the anxiety that comes with potential late filing penalties10911.

Understanding Your W-2 and 1099 Forms

When it comes to income reporting, understanding your W-2 and 1099 forms is essential. These federal tax forms serve distinct purposes and define how income is reported and taxed. Below, you’ll find key details about each form to ensure compliance with tax regulations.

What is a W-2 Form?

The W-2 form is provided by employers to employees every year, showing total salary and tax information. Employers must give this document to their employees by the end of January each year. Alongside the W-2, employers file Copy A with the IRS and a Form W-3, which summarizes wage and tax statements12. Your W-2 indicates the amount withheld for federal, state, and local taxes from your paycheck, including necessary contributions to Social Security and Medicare at rates of 6.2% and 1.45% for both employer and employee12. It’s important to verify your income and deductions listed on this form to ensure accurate tax filing. Even if you don’t receive a W-2 by the filing deadline, you must report all earned income12.

What is a 1099 Form?

The 1099 form is used primarily for reporting income earned by freelancers or independent contractors. Businesses must issue a 1099 form to any contractor they pay at least $600 within a year13. Unlike W-2 forms, there is no tax withholding on payments made to contractors, making them responsible for estimating and paying self-employment taxes quarterly13. Payers must provide 1099 forms to recipients by January 31 and file them with the IRS as well12. Furthermore, starting in the 2024 tax year, third-party payment processors will report transactions only if they exceed a $5,000 threshold, reverting to $600 in 202613. This means freelancers must keep careful track of their income to avoid penalties.

| Form | Purpose | Who Receives It? | Income Reporting |

|---|---|---|---|

| W-2 | Reports wages, tips, and other compensation | Employees | Withholding taxes included |

| 1099 | Reports income for independent contractors | Freelancers, contractors | No withholding; responsible for taxes |

Understanding both forms makes a significant difference in managing your federal tax forms and complying with income reporting regulations. Make sure you’re prepared come tax season13!

Deductions and Credits You Might Claim

Understanding federal tax deductions and tax credits is essential for optimizing your tax return. You can choose between standard deductions and itemized deductions based on your financial situation. Familiarizing yourself with these options helps to significantly reduce your tax burden.

Standard vs. Itemized Deductions

The standard deduction for 2023 is $13,850 for single filers or married individuals filing separately, $27,700 for married couples filing jointly, and $20,800 for heads of household14. These amounts can vary depending on your filing status and are designed to simplify the tax filing process. On the other hand, itemized deductions allow you to deduct specific expenses like mortgage interest, real estate taxes, and charitable donations. Only certain deductions apply when itemizing, which can lower your taxable income more than the standard deduction in some instances.

Common Tax Credits Available

Tax credits can further reduce the amount you owe. For instance, the Child Tax Credit is worth up to $2,000 per child for the 2024 tax year15. You may also qualify for the Earned Income Tax Credit, which ranges from $632 to $7,830 based on your income and number of children15. Other valuable credits include the American Opportunity Tax Credit for education expenses, maxing out at $2,500, and the Charitable Donation Deduction, which allows deductions of up to 60% of your adjusted gross income15. Utilizing tax software can assist you in accurately calculating these deductions and credits, ensuring you maximize your refunds or reduce your taxes owed effectively.

Changes in Federal Tax Laws

As you navigate your financial future, staying aware of the latest updates in federal tax laws is vital. The changes brought about by recent tax legislation updates can significantly affect your financial strategies and obligations. In 2023, various tax reforms introduced new rates and adjustments for the upcoming tax year, ensuring that you are better aligned with current requirements.

Recent Updates in Tax Legislation

For the tax year 2025, the standard deduction for single taxpayers will be $15,000, marking a $400 increase from 202416. Married couples filing jointly will benefit from a standard deduction of $30,000, an $800 increase compared to the prior tax year16. These adjustments are part of a broader trend in federal tax laws, including a top tax rate of 37% for individual single taxpayers with incomes exceeding $626,35016.

Additions to tax legislation updates include ongoing changes to various provisions. The IRS has implemented measures for the Employee Retention Credit (ERC), aiming to mitigate improper claims while facilitating legitimate requests17. Furthermore, significant inflation adjustments have been noted, with thresholds for tax brackets adjusted to reflect economic conditions, allowing some individuals to stay within lower brackets18.

Impact of Tax Reforms on You

Understanding the implications of these tax reforms for 2025 is essential for effective financial planning. For instance, the Earned Income Tax Credit for taxpayers with three or more qualifying children will now reach a maximum of $8,046, compared to $7,830 in 20241618. The IRS’s adjustment measures will also directly benefit taxpayers, with relief provided on nearly 5 million tax returns, targeting those making under $400,000 annually17.

The forthcoming changes in federal tax laws will foster an environment where taxpayers can plan more efficiently, considering the rise in standard deductions and tax credit limits. These reforms reflect federal priorities in supporting taxpayers and ensuring more equitable tax burdens going forward.

Knowing Your Federal Tax Bracket

Understanding your federal tax bracket is essential for effectively planning your finances. The federal income tax system is progressive, meaning different portions of your income are taxed at varying tax rates. In 2024, the federal income tax brackets for Single filing status range from 10% to 37%, with the top bracket starting at $609,350 and above19. Each filing status, whether it be Single, Married Filing Jointly, or Head of Household, has specific brackets that define how much you will pay in federal taxes.

How Tax Brackets Work

In a progressive tax system, as you earn more, you will move through different tax brackets, incurring higher tax rates on the portions of your income that fall within those brackets. For instance, in 2023, Head of Household status has tax brackets that range from 10% to 37% with the highest rate applicable to income exceeding $578,10019. Understanding how these brackets work is crucial, as they determine the specific tax rate applied to your different income ranges.

Factors Influencing Your Tax Rate

Several factors affecting tax rates can influence how much you pay, including your filing status and the specific income levels you occupy. In 2024, there will be seven federal income tax rates ranging from 10% to 37%, with the highest tax rates applying based on your filing status and corresponding income20. Additionally, consideration of deductions and credits can substantially impact your effective tax rate, which represents the total taxes paid as a percentage of your taxable income.

| Filing Status | 2024 Tax Brackets | Top Rate Starts At |

|---|---|---|

| Single | 10% – 37% | $609,350 |

| Married Filing Jointly | 10% – 37% | $693,750 |

| Head of Household | 10% – 37% | $578,100 |

In addition, the tax brackets for 2024 and 2025 are adjusted annually to reflect inflation rates20. Being aware of these factors can empower you to make informed financial decisions that align with your tax obligations.

The Importance of Record Keeping

Maintaining organized tax records is crucial for effective tax record keeping, ensuring compliance with IRS regulations, and optimizing your deductions. Proper documentation, such as receipts and financial statements, plays a pivotal role in preparing accurate tax returns. You may be required to keep your important tax documents for up to three years after filing your return, which underscores the necessity of organizing tax documents efficiently21.

Organizing Your Tax Documents

Effective organization can save you from unnecessary stress during tax season. Use the following methods to help streamline your record-keeping process:

- Digital Tools: Consider electronic record-keeping systems that allow you to scan and save documents to a laptop, flash drive, or the cloud for easy access and safekeeping21.

- Sort by Category: Keep different types of records in labeled folders, such as income, expenses, and deductions.

- Regular Updates: Schedule time monthly to update and organize your documents, preventing a last-minute rush.

Tips for Maintaining Accurate Records

To ensure that your records are complete and accurate, consider the following tips:

- Track Deductible Expenses: Keeping thorough records can help identify deductible expenses, avoiding missed opportunities for tax savings22.

- Document Real Estate Transactions: Establish property bases and maintain records of any improvements made for accurate reporting22.

- Prepare for Audits: Having all necessary documentation organized beforehand can help you be audit-ready and compliant with federal tax laws, reducing the risk of penalties23.

Dealing with Tax Issues

Facing an IRS audit can be stressful for any taxpayer. You may need to carefully navigate through the audit processes to ensure your rights are upheld. Knowing how to prepare for an IRS audit can significantly impact the outcome of this challenging situation. Understanding your obligations and rights is essential when handling tax issues.

How to Handle an IRS Audit

When you receive a notice of an IRS audit, take a deep breath and approach the process analytically. Ensure you gather all relevant documentation, such as wages, expenses, and deductions. Consider seeking help from professionals; only a certain percentage of tax professionals can represent you during the audit process, while others cannot24. This support can ease the complexities you might face while dealing with the IRS.

Options for Resolving Tax Debts

If you find yourself struggling with tax debt, there are several options to consider. Programs such as installment agreements or offer in compromise can help you meet your obligations without overwhelming stress. In fact, many eligible taxpayers can access free help to dispute these issues from Low Income Taxpayer Clinics (LITC)24. Understanding your choices is vital for effective resolution.

| Option | Description | Eligibility |

|---|---|---|

| Installment Agreement | Allows you to pay your tax debt in manageable monthly payments. | Available for most taxpayers with outstanding debt. |

| Offer in Compromise | Lets you settle your tax debt for less than the full amount owed. | Eligibility varies based on your financial circumstances. |

| Tax Counseling Services | Free services provided by agencies like VITA and TCE to help taxpayers resolve issues. | Open to low-income individuals and seniors. |

| Low Income Taxpayer Clinics | Free legal assistance for disputing IRS decisions. | Designed for low-income taxpayers with ongoing disputes. |

Utilizing these resources not only aids in resolving tax debt, but also promotes peace of mind as you navigate your tax obligations24.

Resources for Guidance on Federal Taxes

Finding credible assistance is vital when navigating federal taxes. Numerous federal tax resources exist to help you understand your obligations and rights. The IRS websites serve as key hubs of information, with extensive data about tax regulations and guidance available to taxpayers. You’ll discover a wealth of valuable materials, including the Internal Revenue Code of 1986 (IRC), which is the primary source of federal tax law in the United States25. Historical versions of this code can be found on GovInfo, ensuring you have access to the information you need25.

Websites and Agencies You Can Trust

The IRS regularly publishes official tax guidance. This includes revenue rulings, revenue procedures, and FAQs that address common questions26. Websites focused on tax policy, such as those of the U.S. Department of the Treasury, offer extensive insights into current revenue proposals. The Internal Revenue Bulletin (IRB) is another key way to find IRS tax guidance25.

Utilizing Tax Professionals for Help

It’s often beneficial to enlist the help of tax professionals who understand the complexities of tax regulations. Utilizing their expertise can help you avoid potential pitfalls and enhance your compliance with federal tax laws. Tax professionals often use subscription services like Checkpoint Edge and Tax Notes to access the latest information and detailed interpretations of tax laws. These tools enable them to provide accurate, efficient assistance tailored to your specific needs26

Staying Informed on Future Tax Changes

In a rapidly evolving financial landscape, staying updated on federal tax changes is vital for effective financial planning. You can follow reliable tax news sources to keep yourself informed about upcoming regulatory shifts and potential impact on your tax obligations. Many taxpayers overlook the importance of understanding proposed tax legislation, which can significantly influence future tax liabilities and compliance requirements.

Following Tax-Related News

By regularly checking credible news outlets and tax-related websites, you can gain insights into the latest updates affecting federal tax changes. For instance, the Tax Cuts and Jobs Act has ongoing implications; specifically, extending its provisions could cost around $4.0 trillion between fiscal year 2025 and 203427. Moreover, understanding public opinions around these changes can also prepare you for adjustments in your financial strategies.

Understanding Proposed Tax Legislation

Proposed tax legislation often indicates what adjustments may come and how they will affect taxpayers. For example, maintaining the elimination of personal exemptions could generate over $1.7 trillion in revenue through fiscal year 203427. Awareness of the debates and decisions made by lawmakers will help you navigate and adapt to potential changes effectively. Additionally, the growing trend of relying on AI-powered tools like Checkpoint Edge, which assist tax professionals in researching and understanding the nuances of tax laws, underscores the importance of modernizing your approach to staying informed28.

FAQ

What are my federal tax obligations?

How do I file my federal taxes?

What happens if I miss the federal tax filing deadline?

What forms do I need for filing taxes?

How do I determine my tax bracket?

What are tax deductions and credits?

What are common federal tax issues I might face?

Where can I find resources for federal tax guidance?

How can I stay informed about changes to federal tax laws?

Source Links

- https://www.irs.gov/help/information-about-federal-taxes – Information About Federal Taxes [English]

- https://turbotax.intuit.com/tax-tips/general/what-are-federal-taxes/L4M1hVs8j – What Are Federal Taxes?

- https://smartasset.com/taxes/income-taxes – Federal Income Tax Calculator (2024-2025)

- https://www.irs.gov/newsroom/who-needs-to-file-a-tax-return – Who needs to file a tax return

- https://www.irs.gov/pub/irs-pdf/p2105.pdf – Publication 2105 (Rev. 5-2023)

- https://en.wikipedia.org/wiki/Taxation_in_the_United_States – Taxation in the United States

- https://www.irs.gov/filing/irs-free-file-do-your-taxes-for-free – IRS Free File: Do your taxes for free

- https://www.consumerfinance.gov/consumer-tools/guide-to-filing-your-taxes/ – Guide to filing your taxes in 2024 | Consumer Financial Protection Bureau

- https://www.nerdwallet.com/article/taxes/tax-deadline-tax-day-taxes-due – Tax Day 2025: Filing Due Date and Other Deadlines – NerdWallet

- https://www.irs.gov/newsroom/prepare-to-file-in-2025-get-ready-for-tax-season-with-key-updates-essential-tips – Prepare to file in 2025: Get Ready for tax season with key updates, essential tips

- https://turbotax.intuit.com/tax-tips/tax-planning-and-checklists/important-tax-deadlines-dates/L7Rn92V1d – Every Tax Deadline You Need To Know

- https://apspayroll.com/blog/difference-form-w-2-and-form-1099-misc/ – What is the Difference Between a W-2 and 1099?

- https://turbotax.intuit.com/tax-tips/irs-tax-forms/the-difference-between-a-1099-and-a-w-2-tax-form/L8drkTeTQ – The Difference Between a 1099 and a W-2 Tax Form

- https://www.irs.gov/credits-and-deductions-for-individuals – Credits and deductions for individuals

- https://www.nerdwallet.com/article/taxes/tax-deductions-tax-breaks – 22 Popular Tax Deductions and Tax Breaks – NerdWallet

- https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2025 – IRS releases tax inflation adjustments for tax year 2025

- https://www.irs.gov/newsroom/tax-updates-and-news-from-the-irs – Tax updates and news from the IRS

- https://www.nerdwallet.com/article/taxes/tax-changes – IRS Announces 2025 Tax Brackets, Updated Standard Deduction – NerdWallet

- https://turbotax.intuit.com/tax-tips/irs-tax-return/what-is-my-tax-bracket/L3Dtkab8G – What is My Tax Bracket?

- https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets – 2024-2025 Tax Brackets & Federal Income Tax Rates – NerdWallet

- https://www.investopedia.com/articles/personal-finance/060315/tax-documents-you-should-always-keep.asp – Tax Documents You Should Always Keep

- https://www.forbes.com/councils/forbesbusinessdevelopmentcouncil/2022/08/25/5-reasons-good-record-keeping-can-save-you-money-on-taxes/ – Council Post: 5 Reasons Good Record-Keeping Can Save You Money On Taxes

- https://myhrprofessionals.com/accurate-record-keeping-payroll/ – The Importance of Accurate Record-Keeping for Payroll

- https://www.irs.gov/newsroom/resources-to-help-you-prepare-your-tax-return-and-resolve-tax-disputes – Resources to Help You Prepare Your Tax Return and Resolve Tax Disputes

- https://www.irs.gov/privacy-disclosure/tax-code-regulations-and-official-guidance – Tax code, regulations and official guidance

- https://guides.brooklaw.edu/federal_tax_research – LibGuides: Federal Tax Research Guide: Overview of Sources & Research Guides

- https://tax.thomsonreuters.com/blog/experts-discuss-tax-reform-landscape-in-2025/ – Challenges ahead for 2025 tax reform and TCJA expiration

- https://tax.thomsonreuters.com/blog/how-to-keep-up-with-tax-law-changes/ – How to keep up with tax law changes