Facing a tax audit can feel like standing at the edge of a vast ocean, waves of anxiety crashing in as you contemplate the unknown. You may suddenly find yourself lost in a whirlwind of confusion and uncertainty, wondering what to expect during this intricate audit process. But, take a deep breath. Understanding what a tax audit entails, and preparing accordingly, can transform this daunting journey into a manageable experience. Every year, the IRS randomly selects a small percentage of tax returns for audit, and while the thought can be intimidating, knowledge and preparation are key to navigating these situations with confidence1.

The importance of diligent tax compliance cannot be overstated. By staying informed about changing tax laws and meticulously reviewing your records, you can significantly reduce the stress associated with an audit. The right approach not only mitigates anxiety but can also lead to positive outcomes, whether it’s a clean slate or constructive recommendations for your tax practices. Remember, a well-prepared taxpayer is a confident taxpayer, ready to tackle each step of the audit procedures head-on.

Key Takeaways

- Tax audits are often random and can be managed effectively with proper preparation.

- Understanding your rights and the audit process is crucial for navigating an IRS audit.

- Maintaining organized records reduces the chances of an audit and helps in compliance.

- Reviewing your tax returns for errors can prevent closer scrutiny by auditors.

- Cooperative communication with auditors is vital for a smoother audit experience.

Understanding What a Tax Audit Is

A tax audit is a formal examination of tax returns and related documentation to ensure compliance with tax laws. The IRS conducts these audits primarily to verify the accuracy of the information you reported. While fewer than 1 percent of tax filers undergo a tax audit each year, those selected often belong to certain categories, such as high earners making over $500,000 annually or self-employed individuals due to their complex income structures2.

Definition of a Tax Audit

In essence, a tax audit serves as a detailed review of your financial documents and statements to ensure that you report your income and deductions correctly. Every auditor’s goal is adherence to tax regulations, which can highlight discrepancies or errors in your filing. Understanding this concept is crucial for successfully navigating the audit process.

Types of Tax Audits

There are various audit types that the IRS may employ to review tax returns:

- Correspondence Audits: These make up approximately 75 percent of all IRS audits and are typically conducted through mail, requiring you to provide specific documentation.

- Office Audits: Conducted in an IRS office, they involve a scheduled meeting where taxpayers must present relevant records.

- Field Audits: These audits are the most thorough, performed on-site at your home or business, where auditors review your operations and accounting procedures3.

Each type targets different aspects of compliance, depending on the complexity and nature of the tax situation.

Who Conducts Tax Audits

IRS auditors are primarily responsible for conducting tax audits. These professionals are trained to analyze tax documents and assess compliance with tax laws. Taxpayer Compliance Measurement Program (TCMP) audits are particularly intensive, requiring documentation for every line of your tax return2

Common Reasons for Being Audited

Understanding the common reasons for tax audits is crucial for every taxpayer. The IRS focuses on several key audit triggers that can lead to increased scrutiny of your tax returns. Among the most pressing factors are unreported income and high deductions, which can raise red flags. Additionally, it’s important to note that while many audits may appear random, certain patterns and anomalies significantly influence the likelihood of being selected.

Unreported Income

Failing to report all your income is one of the leading triggers for an audit. The IRS is vigilant about monitoring financial discrepancies, and any unreported income can prompt further investigation4. Even minor inconsistencies in reported figures can spark an audit, as meticulous verification processes are in place to ensure compliance with tax regulations.

High Deductions

Another significant audit trigger is the reporting of high deductions, especially if they seem disproportionate to your income. The IRS pays close attention to claims that may appear inflated based on your reported earnings. For instance, excessive charitable donations or losses reported on Schedule C can attract scrutiny, raising concerns about accuracy and legitimacy4. Individuals earning $500,000 or more, for instance, face audits at higher-than-average rates due to the complexity and volume of their deductions5.

Random Selection

Lastly, it’s essential to recognize the element of chance in audits. The IRS occasionally selects tax returns randomly, regardless of their content, which highlights the unpredictable nature of tax audits4. In 2022, just 0.49% of individual tax returns were selected for audits, meaning fewer than one out of every 100 returns faced this level of scrutiny5. Understanding these common reasons can better prepare you for potential audit scenarios.

How to Prepare for a Tax Audit

Preparing for a tax audit requires meticulous attention to detail and organization. Being ready can significantly ease the process, helping you navigate through audit preparation smoothly. Start by gathering the necessary documentation to showcase your tax records clearly.

Gather Necessary Documents

When preparing for your audit, collect all essential documentation, including:

- Financial statements

- Previous tax returns

- Receipts for deductible expenses

- Bank statements

These documents will serve as key evidence during your audit and ensure you can substantiate your claims effectively.

Review Your Tax Returns

Conduct a thorough review of your tax returns for any discrepancies or errors. Taxpayers should be aware that in 2017, less than 1% of taxpayers earning under $500,000 faced audits, yet issues in your returns could trigger scrutiny6. Make sure that all reported income aligns with third-party reports and verify that expenses are legitimate and well-documented.

Organize Your Records

A well-organized set of records will facilitate quick responses to auditors’ queries. An IRS field audit, which is the most extensive type of audit, may require detailed scrutiny of your documentation6. Keep your records categorized by type and year, and always ensure they are easily accessible. This preparedness not only proves beneficial during audits but enhances your overall financial management.

| Document Type | Purpose | Retention Period |

|---|---|---|

| Financial Statements | Verify financial status and income | At least 7 years |

| Previous Tax Returns | Provide historical tax data | At least 3 years after filing |

| Receipts | Substantiate deductible expenses | At least 3 years |

Taking these steps will help ensure your documentation is in order, reducing stress during the audit process and allowing for a smoother experience7.

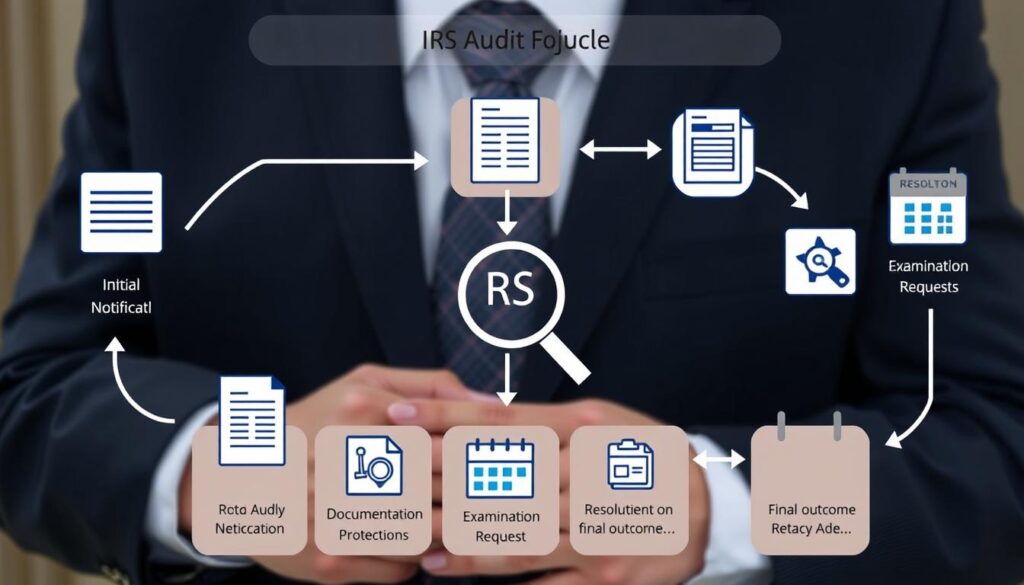

What to Expect During a Tax Audit

Understanding the IRS audit process is essential for taxpayers facing an audit. Knowing what to expect can help you navigate the experience with confidence. The audit typically unfolds in several stages, encompassing notification, examination, and resolution. Be prepared for varying levels of auditor communication throughout the process as you provide necessary documentation.

The Audit Process

The audit process involves a systematic approach, starting with the receipt of an audit notice. This initial notification outlines what the IRS intends to examine in your financial records. In 2019, fewer than half of 1% of individual tax returns were audited by the IRS, indicating that audits are not as common as many might believe8. Once you receive the notice, it is crucial to respond promptly to initiate the audit timeline. Auditors will examine your records to identify if you have underpaid or overpaid taxes, ensuring compliance with tax laws9.

Communication with Auditors

Maintaining effective auditor communication is vital during a tax audit. Auditors may request additional information or documentation to clarify discrepancies. Taxpayers are required to retain all records for a minimum of four years, though audits may scrutinize longer periods in cases of fraud9. Effective communication can facilitate a smoother process and help you address any concerns raised by the auditor.

Timeline for Completion

The audit timeline can vary significantly, often stretching from weeks to several months. In 2020, roughly 0.2% of individual filers earning between $200,000 and $500,000 were audited, with the timeline for these cases depending on the complexity of the issues involved8. Be aware that higher income earners face a greater likelihood of audits; in fact, 8.7% of individuals earning $10 million or more were audited in 20198. Responding promptly to requests from the IRS can be essential in expediting the overall audit process.

Your Rights During a Tax Audit

When facing a tax audit, it’s essential to understand that taxpayer rights are in place to protect you and ensure fairness throughout the process. Knowing your rights can empower you during what may seem like an overwhelming experience.

The Right to Representation

You have the right to audit representation. This means you can bring in an accountant, attorney, or any qualified representative to assist you throughout the audit process10. Having a professional by your side can provide significant advantages, especially when navigating complex tax issues. Your representative can communicate with the IRS on your behalf, allowing you to focus on your business and personal needs.

The Right to Appeal

If you disagree with the auditor’s findings, you have the right to appeal their proposed changes. The process allows you to take your case to the Appeals Office of the IRS11. It is crucial to file your appeal within the set timeframe, generally 30 days from the date of the Notice of Determination10. During this period, it’s advisable to prepare a written petition explaining your reasons for disagreement along with any supporting facts.

Confidentiality Protections

Confidentiality is another critical right you hold during a tax audit. The IRS and respective state tax agencies are required to safeguard your information and use it solely for legitimate purposes10. It ensures that your sensitive financial data remains protected throughout the entire process. Understanding these confidentiality protections can help alleviate concerns about the misuse of your information.

Tips for Staying Calm and Cooperative

A tax audit can lead to significant anxiety for many taxpayers. Understanding effective audit stress management techniques can greatly alleviate some of the tension. By implementing strong communication strategies and maintaining cooperation during audit meetings, you can ensure a smoother experience.

Managing Stress

Panic often arises upon receiving an audit notice, with a high percentage of taxpayers experiencing overwhelming anxiety in such situations12. To manage stress effectively, consider practicing mindfulness and relaxation techniques to help calm your nerves. Keeping organized records can lead to a smoother and less stressful audit process, allowing you to feel more in control.

Effective Communication

Timely communication with your auditor is crucial for resolving issues promptly12. Utilize various means of contact such as phone calls, emails, or in-person meetings to clarify any doubts or concerns. Keep in mind that maintaining copies of your communications with tax authorities can be valuable for future reference and follow-ups.

Staying Focused

Cooperation during audit proceedings is essential. Focusing on the objectives, such as providing necessary documents like tax returns and receipts, will facilitate a more productive environment13. Seeking guidance from a tax agent can also reduce misunderstandings and offer valuable support throughout the process12.

The Role of Tax Professionals in Audits

Understanding the complexities of a tax audit can be daunting. Engaging a tax advisor can provide you with essential support to navigate through the process. Knowing when to hire a tax professional, the benefits of their assistance, and how to choose the right one is crucial for effective audit defense.

When to Hire a Tax Professional

If you receive an audit notice or feel overwhelmed by potential tax issues, it is wise to seek professional audit assistance. Engaging a tax professional early in the process can mitigate stress and help streamline your response to the IRS.

Benefits of Professional Help

- Expert Representation: Tax professionals, including enrolled agents, certified public accountants, and attorneys, possess unlimited representation rights before the IRS14.

- Stress Reduction: Having a tax advisor handle communications with auditors can significantly relieve your stress during the audit process.

- Informed Decision-Making: Tax professionals bring unparalleled knowledge to your case, providing not only representation but strategic insight into your tax situation.

How to Choose the Right Professional

Selecting the right tax professional entails evaluating their credentials, experience, and overall suitability for your needs. You can verify qualifications through the IRS’s searchable database, which allows you to check the credentials of tax return preparers14 and find someone who aligns with your specific tax scenario.

Responding to an Audit Notice

Receiving an IRS audit notice can be overwhelming, yet knowing how to respond appropriately can set you on the right path. The first step is understanding the notice you have received. An important indicator that an IRS letter is an audit notice is receiving it through certified mail, requiring a signature upon receipt15. These letters are always sent via traditional mail and never through email or phone notification15.

Understanding the Notice

The audit notice will detail the specific items being questioned and request supporting documentation. The types of documentation required can vary depending on the circumstances of the audit and the issues under review15. It is crucial to carefully review the notice to determine exactly what information is required for a complete audit notice response.

Required Actions

- Gather all relevant documents, such as receipts, bank statements, and tax returns.

- Ensure that your responses are complete and accurate to avoid difficulties in resolving any tax issues16.

- Consider seeking professional help if you feel overwhelmed; a significant portion of individuals opt for assistance during audits16.

Important Deadlines

The IRS typically provides a specific timeframe to respond to an audit letter, so be aware of the audit deadlines16. Failing to respond within the given time can lead to penalties, enforced collection actions, and interest16. Ignoring an initial audit notice can risk having the entire line item disallowed by the auditor17.

Common Audit Myths Debunked

Tax audits can generate a swirl of anxiety, often fueled by common audit myths and IRS misconceptions. It’s essential to understand the truth behind these myths to navigate the audit process with confidence.

Myth: Only Rich People Get Audited

A prevalent belief is that only wealthy individuals face audits. In reality, the IRS audits around 1% of tax filers, regardless of their income levels18. Taxpayers with high income levels are often more scrutinized due to the complexity of their financial situations. Nonetheless, ordinary taxpayers can find themselves under review as well, particularly when claiming deductions that raise red flags, such as home office expenses or substantial charitable contributions19.

Myth: Auditors Are Out to Get You

Many individuals think auditors are solely focused on finding faults, with approximately 83% believing auditors seek out mistakes20. This perception often leads to misconceptions about the relationship auditors have with taxpayers. The truth is, auditors engage with employees at all levels and strive to ensure compliance rather than act adversarially20. They utilize data analytics to identify discrepancies, necessitating a thorough understanding of your tax situation.

Myth: You Shouldn’t Respond

Another damaging myth suggests that ignoring an audit notice is a viable option. This could not be further from the truth. Prompt and proper audit response is crucial. The IRS has established their auditing procedures, and correspondence audits are often resolved through communication, not silence18. Additionally, having a tax professional to assist can significantly ease the burden of the audit response, ensuring that you are prepared and that your rights are protected19.

Navigating Complex Tax Issues

Facing a tax audit can bring to light various complex tax issues that require careful attention. You may encounter situations involving business expenses and deductions, charity contributions, and foreign income reporting. Understanding how to navigate these matters can significantly impact the audit’s outcome.

Business Expenses and Deductions

Accurate reporting of business deductions is crucial during a tax audit. You need to ensure that all expenses related to your business operations are legitimate and well-documented. Common deductions include costs for supplies, travel, and meals. The IRS often scrutinizes high deductions, so proper organization and justification are essential.

Charity Contributions

Charitable donations can provide valuable deductions on your taxes. It’s necessary to maintain accurate records of these contributions, including receipts and acknowledgment letters. Notably, in cases where contributions are significant, verify that the charity is recognized by the IRS to avoid complications21. Understanding the rules surrounding these donations can help you defend your deductions if questioned.

Foreign Income Reporting

When you earn international income, it is important to comply with foreign income tax regulations. Make sure you report all foreign earnings, as failure to do so can result in substantial penalties. Utilizing expert advice can aid in navigating international tax treaties and ensure proper compliance based on current laws22. Take the necessary steps to maintain detailed records of any foreign investments or income to support your filings.

The Potential Outcomes of an Audit

Understanding the potential outcomes of a tax audit can significantly impact your financial planning and strategy. At the conclusion of an audit, several scenarios can arise, each with different implications for your tax liabilities, tax refunds, or overall fiscal health.

No Change

In some cases, the audit leads to no change in your reported income or tax status. This outcome happens when your records are accurate and all relevant information has been disclosed correctly. With no adjustments required, audit outcomes in this category mean a peace of mind this time around.

Refunds and Credits

When discrepancies are uncovered in your favor, you may be entitled to tax refunds or credits. Audit findings could reveal overpayments or erroneous charges that allow you to reclaim taxes previously paid. This situation highlights the importance of maintaining accurate records, as you may be eligible for significant refunds depending on the audit outcomes23. If the audit identifies sections where deductions were improperly excluded, you might receive a corresponding credit that directly impacts your financial situation positively.

Additional Taxes Owed

Conversely, audits frequently reveal underpaid taxes, resulting in a necessity to pay additional taxes owed. This scenario can introduce unexpected tax liabilities, which may include penalties and interest on the outstanding amount. The implications of these findings can endure beyond the audit itself, potentially affecting your business operations or financial stability2425.

After the Audit: What’s Next?

Once your audit is complete, you face several essential steps that can significantly impact your future compliance and success. You are now tasked with critically assessing the audit findings, navigating the appeals process if necessary, and implementing effective post-audit record keeping to avoid complications down the line.

Reviewing the Audit Findings

The first step after the audit is conducting a thorough audit findings review. Understand the conclusions drawn by the auditor and ascertain how they affect your tax situation. The IRS may accept your tax return as filed or suggest changes, which could alter what you owe or may refund you26. Any discrepancies can lead to further questions or potential audits, so take the time to address any audit findings meticulously.

Appeals Process

If you disagree with the auditor’s findings, you possess the right to engage in the appeals process. You can file a protest letter within 30 days of receiving the audit report to contest the findings26. Taxpayers who believe they were unfairly treated during an audit may request a reconsideration of their case under specific conditions, such as moving before receiving IRS communications or wanting to present new information26.

Keeping Future Records

Effective post-audit record keeping is vital for ensuring your compliance in future tax years. Keep detailed records of all documentation submitted during the audit process and maintain accurate financial records moving forward. This diligence can save you from potential issues in subsequent audits, particularly if significant discrepancies in your tax returns raised red flags for the IRS27. Revisiting your record-keeping system following an audit can help you stay organized and prepared.

Maintaining Good Practices Post-Audit

After navigating a tax audit, it’s crucial to establish practices that can not only safeguard your finances but also minimize any risk of future audits. Engaging in proactive tax planning strategies can create a solid financial foundation. By analyzing your past deductions and current revenue, you’ll be better equipped to make informed decisions, ensuring compliance with tax regulations while optimizing your financial situation.

Tax Planning Strategies

Implementing effective tax planning can greatly enhance your fiscal decision-making. This involves understanding your financial landscape, setting aside funds for potential future liabilities, and identifying legitimate deductions. It’s essential to continuously evaluate your approach to tax planning in light of any tax law updates, ultimately aligning your methods with any regulatory changes to remain compliant.

Record Keeping Best Practices

The importance of meticulous record keeping cannot be overstated. Keeping organized financial records not only prepares you for future audits but also instills confidence during tax preparation. Consider utilizing document management systems to store and retrieve necessary information easily. By maintaining detailed records, you’ll be able to accurately substantiate your claims, protecting yourself from unwarranted deductions or penalties during post-audit scenarios2829.

Staying Informed on Tax Laws

Finally, staying informed about tax law updates is vital. Changes in tax legislation can impact your financial obligations and planning strategies. Regularly reviewing the latest tax scenarios and connecting with a tax professional can ensure that you remain compliant and informed. Knowledge is key to navigating the complex landscape of taxation, and being proactive can spare you from future audit nightmares and financial pitfalls.

FAQ

What is a tax audit?

What types of tax audits exist?

Who conducts tax audits?

Why might I be audited?

How can I prepare for a tax audit?

What should I expect during the tax audit process?

What rights do I have during a tax audit?

How can I manage stress during a tax audit?

When should I hire a tax professional for a tax audit?

What should I do when I receive an audit notice?

What are some common misconceptions about tax audits?

What complex tax issues should I be aware of during an audit?

What potential outcomes can result from a tax audit?

What steps should I take after the audit concludes?

How can I maintain good practices to prevent future audits?

Source Links

- https://www.armanino.com/articles/navigate-irs-business-audit/ – Navigate an IRS Business Audit With Confidence (and Lower Your Odds of One)

- https://taxfoundation.org/taxedu/glossary/audit/ – What Is a Tax Audit?

- http://tax.vermont.gov/help/audits – What is an Audit | Department of Taxes

- https://www.nerdwallet.com/article/taxes/reasons-irs-audit – 7 Reasons the IRS Will Audit You – NerdWallet

- https://www.empower.com/the-currency/money/irs-audit-triggers – IRS audit triggers

- https://www.debt.org/tax/irs-audit/ – How to Deal with the IRS During a Personal Tax Audit; Rights & Tips

- https://www.bakertilly.com/insights/audit-preparation-5-tips-successful-irs-audit – Audit preparation: 5 tips for a successful IRS audit | Baker Tilly

- https://www.investopedia.com/articles/personal-finance/032415/how-do-irs-audits-work.asp – How Do IRS Audits Work?

- https://comptroller.texas.gov/taxes/audit/process.php – The Auditing Process

- https://www.sambrotman.com/the-ultimate-guide-to-california-sales-tax-audits/your-rights-as-a-california-taxpayer/ – Your Rights as a California Taxpayer | Brotman Law

- https://www.irs.gov/pub/irs-pdf/p1.pdf – Publication 1 (Rev. 9-2017)

- https://whitsondawson.com.au/how-to-handle-a-tax-audit-tips-best-practices/ – How to Handle a Tax Audit: Tips & Best Practices

- https://creativetax.io/state-income-tax-audit/ – Survive Your State Income Tax Audit: Tips & Tricks | Creative Tax Solutions

- https://www.irs.gov/pub/irs-news/FS-15-06.pdf – IR-2003-

- https://vataxattorney.com/sample-irs-audit-letters-you-might-receive-how-to-respond/ – Sample IRS Audit Letters You Might Receive & How To Respond

- https://atltaxlawyers.com/what-to-do-when-you-receive-an-irs-audit-letter/ – What to Do When You Receive an IRS Audit Letter

- https://www.fletchertilton.com/first-steps-in-responding-to-tax-audit-notices/ – First Steps in Responding to Tax Audit Notices – Fletcher Tilton PC

- https://turbotax.intuit.com/tax-tips/irs-tax-return/top-5-myths-about-tax-audits/L5W989jzq – Top 5 Myths About Tax Audits

- https://www.caltaxadviser.com/common-myths-about-irs-audits-and-the-truth-behind-them/ – Common Myths About IRS Audits and the Truth Behind Them – Milikowsky Tax Law

- https://journalrecord.com/2023/03/14/sinning-debunking-common-myths-about-auditors-auditing/ – Sinning: Debunking common myths about auditors, auditing

- https://www.merriamlaw.com/blog/how-to-navigate-irs-audits-what-taxpayers-need-to-know/ – How to Navigate IRS Audits: Comprehensive Guide & Post-Audit Process | Expert Tax Defense

- https://www.jdavidtaxlaw.com/blog/navigating-irs-audits-the-role-of-tax-audit-representatives/ – Navigating IRS Audits: The Role of Tax Audit Representatives

- https://pmc.ncbi.nlm.nih.gov/articles/PMC9485024/ – Real effects of tax audits

- https://blog.turbotax.intuit.com/life/tax-audits-explained-not-as-scary-as-you-think-6519/ – Tax Audits Explained & Potential Audit Triggers | Intuit TurboTax Blog

- https://www.thorntaxlaw.com/practices/criminal-tax-audits/ – Ultimate Guide: Tax Audits, Criminal Tax Law | DC Tax Audit Lawyer

- https://www.taxpayeradvocate.irs.gov/news/tax-tips/tas-tax-tip-what-to-do-if-you-receive-notification-your-tax-return-is-being-examined-or-audited-2023/2023/07/ – What to do if you receive notification your tax return is being examined or audited

- https://www.aicpa-cima.com/resources/article/6-things-to-know-about-surviving-an-irs-audit – 6 Things to Know about Surviving an IRS Audit

- https://accountants.sva.com/a-guide-to-audits-prep-planning-and-post-audit-tips – A Guide to Audits: Prep, Planning, and Post Audit Tips

- https://www.smyyth.com/blog/best-practices-post-audit-deductions/ – 10 Best Practices for Post Audit Deductions | Smyyth