To find out if you owe back taxes, start by checking any IRS notices you've received, like CP14 or CP502, which detail amounts owed. Next, review your past tax returns for unreported income or inaccuracies in deductions. Access your IRS online account to see your balance and payment history. If you still have questions, consider contacting the IRS directly or consulting a tax professional who can assess your situation. Understanding these points will help clarify your tax obligations, and you'll uncover even more helpful tips as you explore further.

Key Takeaways

- Review any IRS notices received, such as CP14 or LT38, for information on unpaid taxes and collection activities.

- Check your IRS online account to view your tax account balance and any amounts owed from previous years.

- Examine past tax returns for unreported income, discrepancies, and eligibility of claimed deductions and credits.

- Request transcripts from the IRS to verify payments made, outstanding balances, and any penalties assessed.

- Consult a tax professional for assistance in understanding your tax obligations and to navigate complex financial situations.

Checking for IRS Notices

When you suspect you might owe back taxes, the first step is to check for any IRS notices you may have received. These notices are the IRS's primary form of communication regarding your tax issues, serving various purposes. Some simply provide information, while others require immediate action.

Common notices include the CP14, indicating unpaid taxes, and the CP502, which follows up on the CP14 with updated amounts and a firmer tone. If you receive an LT38, it means the IRS is resuming collection activities on unpaid balances. Each notice contains important details like the amount owed, any penalties or interest, and due dates for payment. Understanding these notices is crucial to avoid penalties or further issues related to IRS correspondence.

It's crucial to retain these notices, as they create a reliable paper trail of your tax transactions. Carefully review each document to understand any required actions, whether it's making a payment, responding, or appealing.

If you disagree with the notice, respond in writing with your reasons and any supporting documentation. When in doubt, consulting a tax professional can help you navigate the complexities of IRS correspondence and ensure you're taking appropriate steps.

Reviewing Past Tax Returns

After checking for IRS notices, the next important step involves reviewing your past tax returns for any errors or omissions.

Start by checking for unreported income. Look at all income sources, including wages, dividends, and self-employment income. Make sure all Forms 1099 and W-2 are accounted for and verify if you missed or underreported any income.

Next, verify your deductions and credits. Ensure you claimed all eligible deductions and check for any missed or incorrectly calculated ones. Review itemized versus standard deductions and confirm the accuracy of dependent and education credits.

Also, examine your tax forms and schedules for completeness and accuracy. Make sure you filled out the correct forms for each tax year and included all necessary attachments.

Finally, compare your current return to previous years. Look for significant differences in income, deductions, or credits, and use tax comparison worksheets to highlight changes. Identifying discrepancies now can help you address potential issues before they escalate into bigger problems with the IRS. This process includes a top-side review, which can help identify major errors that may have been overlooked.

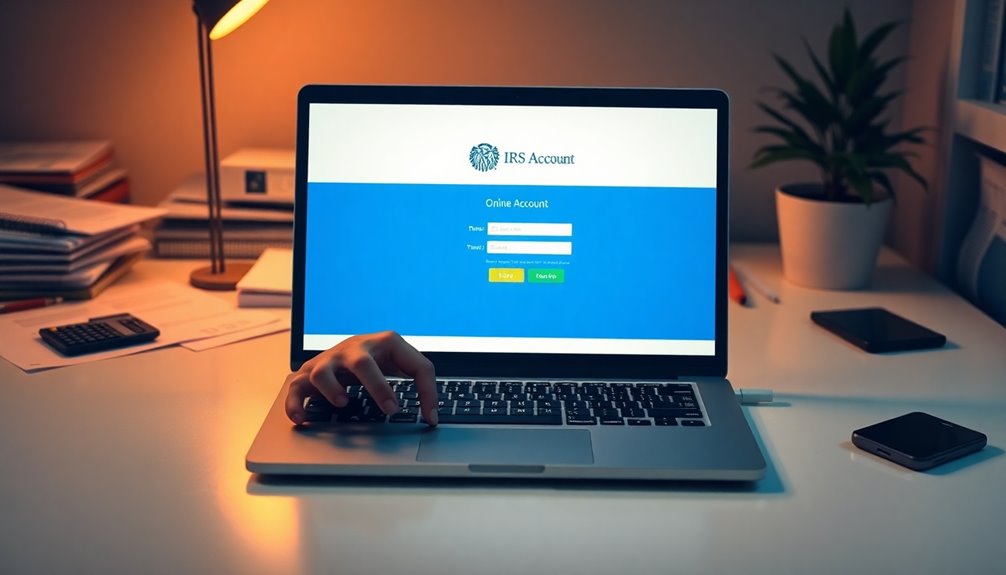

Accessing Your IRS Online Account

Accessing your IRS online account is a straightforward way to stay informed about your tax status. To get started, simply sign in on the IRS website. If you don't have an account yet, you can easily set one up.

Your online account provides valuable insights into your individual tax information, including your tax account balance and any amounts owed from previous years.

Once logged in, you can navigate the platform to view your tax records, payments made, and any adjustments to your account. You'll also find details about penalty assessments, interest charges, and filed tax returns. It's important to note that interest and penalties continue to accumulate over time, increasing the total owed.

This information is crucial for understanding your financial status with the IRS.

If you need more details, consider requesting transcripts directly through your account. These can include account transcripts, wage and income transcripts, or return transcripts.

They help verify your financial status and identify any discrepancies with IRS notices.

Contacting the IRS Directly

If you need to clarify your tax situation, contacting the IRS directly can provide you with the answers you seek. Call the IRS at 1-800-829-1040 during their support hours, which are 7 AM to 7 PM local time, Monday through Friday. Start by selecting your preferred language—press 1 for English or 2 for Spanish. Once that's done, choose the appropriate option for your tax question; press 2 for personal income taxes or 1 for inquiries about a previously filed form or payment.

Before you call, have your Social Security number and relevant tax documents ready, such as prior-year tax returns and any IRS correspondence. This preparation will help expedite the process. Be aware that wait times can be long, especially for simpler inquiries. To avoid being on hold, consider entering the callback queue for a more convenient experience.

If your question relates to business tax returns, you can reach out at 1-800-829-4933. For specific issues like lost IRS checks, call 800-829-1954. Alternatively, you can visit a local IRS office by scheduling an appointment at a Taxpayer Assistance Center.

Consulting a Tax Professional

How can you navigate the complexities of your tax situation effectively? Consulting a tax professional is a smart move if you suspect you owe back taxes. They can help you gather crucial records like W-2s, 1099s, and mortgage interest statements, ensuring you don't miss anything important.

Contacting the IRS for a wage and income transcript is another step where a tax expert can guide you.

If your financial situation is complex—like if you're self-employed or have foreign income—professional help becomes even more vital. The time required to prepare each tax return can pile up quickly, and a professional could save you hours of work. Additionally, they can help you understand the importance of resolving back taxes to prevent further financial complications and legal issues.

Moreover, their expertise often results in reduced penalties and tax liabilities, making the cost worthwhile.

When hiring a tax preparer, expect to pay between $170 and $250, depending on your location and the complexity of your case. Online services may offer cost-effective solutions, but ensure you choose one that suits your needs.

Ultimately, having a tax professional in your corner can relieve stress and help you negotiate with the IRS effectively.

Understanding Penalties and Collection Periods

Navigating the intricate world of tax penalties and collection periods can feel overwhelming, but understanding them is essential for managing your financial obligations effectively.

First, be aware of the penalties you could face. The Failure to File Penalty kicks in if you don't file your tax return by the deadline, potentially reaching up to 47.6% of the net amount due. Additionally, a failure to pay penalty of 0.5% per month on unpaid taxes can accrue, maxing out at 25%. If you underestimate your estimated tax payments, you might incur an Estimated Tax Penalty.

Regarding collection periods, the IRS has a strict Statute of Limitations—10 years from the assessment date to collect unpaid taxes. If you file late, this clock starts when the IRS processes your return. However, you can extend this period by entering into an agreement with the IRS, such as an installment plan.

Frequently Asked Questions

How Can I Dispute a Tax Amount I Believe Is Incorrect?

To dispute a tax amount you believe is incorrect, start by reviewing your tax return and any IRS notices.

Prepare a formal written protest, clearly stating your appeal and including relevant documentation.

You can request an appeals conference with the IRS Appeals Office to discuss your case.

If you're still unsatisfied, you can take your dispute to U.S. Tax Court, but make sure to file within the required timeframe.

What Happens if I Can't Pay My Back Taxes?

If you can't pay your back taxes, the IRS may take enforcement actions, like seizing your assets or garnishing your wages.

They can file tax liens to secure their interest in your property.

However, you have options, such as setting up a payment plan or submitting an Offer in Compromise to settle for less.

It's crucial to communicate with the IRS and explore relief options to avoid severe consequences.

Can I Set up a Payment Plan With the IRS?

Yes, you can set up a payment plan with the IRS.

If you owe less than $100,000, you're eligible for a short-term plan, and if it's under $50,000, a long-term plan works too.

You'll need to file all required tax returns first.

You can apply online using the IRS' Online Payment Agreement tool or by phone.

Just remember, regular payments are mandatory to keep your plan active.

Will My Back Taxes Affect My Credit Score?

Your back taxes won't directly affect your credit score since the IRS doesn't report tax debt to credit bureaus.

However, if you don't pay your taxes, the IRS might file a tax lien, which, while not on credit reports since 2018, can still influence creditors' decisions.

Additionally, owing taxes can lead to financial stress, increasing your debt-to-income ratio, which can impact your ability to secure new credit in the future.

How Long Does the IRS Have to Collect Back Taxes?

The IRS has ten years to collect unpaid taxes from the date they assess your tax liability.

This period starts either when you file your return or its due date, depending on which is later. If you file late, the clock starts when the IRS processes your return.

Keep in mind, certain actions like filing for bankruptcy can pause this timeframe, so it's essential to stay informed about your tax situation.

Conclusion

In conclusion, knowing if you owe back taxes is crucial for your financial health. By checking IRS notices, reviewing past returns, and accessing your online account, you can stay informed. Don't hesitate to reach out to the IRS directly or consult a tax professional if you need help. Understanding penalties and collection periods can also keep you prepared. Taking these steps will help you avoid surprises and give you peace of mind regarding your tax situation.