To buy tax delinquent property in Alabama, start by checking auction dates with the county tax office. You'll need to register through the GovEase Auction Portal, providing necessary documents. During the auction, bids are based on interest rates, so familiarize yourself with the process. Once successful, confirm your purchase with the probate court and demand possession of the property. Be aware of the redemption period, which lasts three years, allowing original owners to reclaim their property. Tackling potential title issues is crucial for securing your investment, and you'll find more tips on navigating this process efficiently.

Key Takeaways

- Verify auction dates and bidder registration requirements through the county tax office and the GovEase Auction Portal.

- Understand the bidding process, which involves an "interest rate bid down" format starting at 12% per annum.

- Prepare payment arrangements, as payments can be made in person, by mail, or online with a convenience fee.

- Post-sale, obtain a certificate of purchase and demand possession; eviction may be necessary if the original owner remains.

- Consult a legal expert to navigate title issues and ensure clear ownership rights after purchasing tax delinquent property.

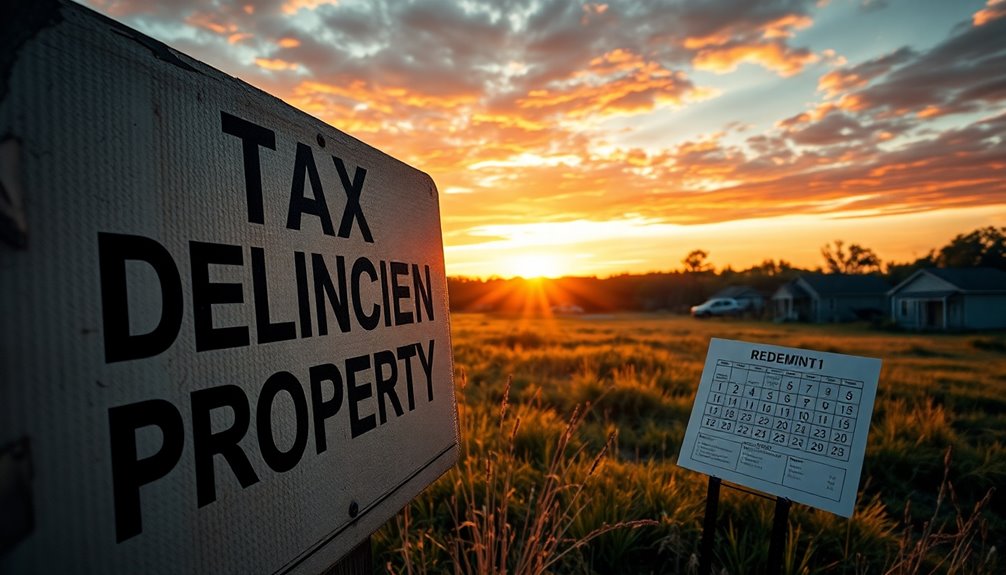

Understanding Tax Delinquent Properties

Tax delinquent properties are essentially real estate that hasn't had its property taxes paid on time, leading to potential financial opportunities for buyers. These properties are defined as those with unpaid taxes from any party that were due and payable.

When a property owner fails to pay their taxes by January 1st, the property becomes delinquent. To recover the owed taxes, these properties can be sold at public auctions. If they don't sell, they may eventually be transferred to the State of Alabama.

You should understand the difference between tax liens and tax deeds. A tax lien is a claim against the property sold to investors as tax lien certificates, while a tax deed grants you rights to the property itself after a redemption period. The redemption period lasts three years, during which the original owner can pay their debts to reclaim the property. It's crucial to be aware of local regulations, as properties sold through tax deeds may not come with a clear title.

Evaluating the property's condition, location, and market value is essential before making a purchase.

Preparing for the Tax Sale

Preparing for a tax sale involves understanding key details that can significantly impact your bidding strategy.

First, check the auction dates and times set by your county tax office. These are announced in advance, and auctions run each business day until all parcels are offered. Make sure to note the specific times for online auctions, as they typically take place from 8:30 AM to 4:00 PM CDT.

Next, familiarize yourself with the bidding process. Bidding uses an "interest rate bid down" format, starting at 12% and decreasing in 1% increments. The lowest interest rate bid wins, with any ties at 0% resolved randomly. It is important to remember that bidders purchase tax liens, not property ownership.

Financially, prepare by understanding the security deposit requirements, which can be around $100 in some counties.

For online auctions, a 10% deposit of your approved bid amount might be necessary. Ensure you can make full payment by the specified deadline, usually by 2 PM on sale day, using accepted payment methods like cash or money orders.

Registration Process

Navigating the registration process is crucial for successfully bidding on tax delinquent properties in Alabama. Start by creating a bidder profile through the GovEase Auction Portal. Head over to www.govease.com to kick off your registration. Fill out the online registration form, ensuring you provide all required information and add auctions for each county where you plan to bid. Be mindful of the specific registration dates set by each county, as these must be met.

Next, you'll need to electronically submit county-specific registration documents via the GovEase portal. Complete and submit the necessary forms, including a W-9 form, within the designated registration period. Keep in mind that each county might've different requirements, so review their submission guidelines carefully. Additionally, ensure you are familiar with the specific regulations regarding tax lien auctions in Alabama, as this knowledge can be beneficial during the bidding process.

After submitting your documents, make payment arrangements with the County Revenue Commissioner's Office. Payments are usually handled through the county tax office, but check if your county allows payment through the GovEase portal. To ensure your approval for bidding, confirm that these arrangements are accepted by the county tax office.

Regularly monitor your registration status via the "My Registrations" link on your GovEase account to avoid any hiccups.

Bidding Process

Typically, the bidding process for tax delinquent properties in Alabama revolves around the interest rate you're willing to accept rather than the actual dollar amount you're prepared to pay. Bidding starts at a maximum interest rate of 12% per annum, and you'll make your bids in 1% increments. The auction continues until no one bids lower or the rate hits 0%. The lowest interest rate bid wins the auction.

Tax lien auctions take place between March 1 and June 15 each year. A list of properties available for auction is published by March 25, detailing owner names, parcel numbers, and delinquent amounts. If a property owner pays their delinquent taxes before the auction, it may be removed from the list. Successful bidders will receive a bid report within 10 business days post-auction, detailing the purchased parcels and other relevant information.

It's crucial to stay updated on any changes to auction dates, as they can vary. Once you win, be aware that all sales are final. Within 10 days post-auction, the Tax Collecting official will notify the property owner of the auction and your details as the purchaser.

Payment Methods

When you win a bid for tax delinquent property in Alabama, knowing how to pay is essential to finalize your purchase. You have several options for payment, each with its own procedures.

Firstly, you can make in-person payments at the Revenue Commissioner's Office. Accepted methods include cash, check, and money order, with credit and debit cards possibly accepted for a convenience fee. Check the designated hours for in-person payments at your local office, like Mobile County or Geneva County.

If you prefer to mail your payment, send a check or money order to the specific county revenue office, ensuring it's addressed correctly—like sending to P.O. Box 326, Geneva, AL 36340 for Geneva County. Remember, payments must arrive by the deadline to avoid penalties. Additionally, be aware that county auctions primarily occur in spring, which may affect your payment timeline.

Online payments are available 24/7 through designated websites, accepting credit or debit cards, but be aware of the 2.50% convenience fee charged by services like Paymentus.

Lastly, if you have a mortgage, your mortgage company can handle payments on your behalf, using your escrow funds, which can simplify the process for you.

Redemption Period Explained

After securing your tax delinquent property, understanding the redemption period is vital. In Alabama, if your property is bought by a third party, you'll have a three-year window from the tax sale date to redeem it.

Anyone with an interest in the property, like lienholders or mortgagees, can also step in during this period. To redeem, you'll need to pay the amount the purchaser paid at the tax sale, along with any subsequent taxes, accrued interest, and fees.

For properties purchased by the state, the redemption period lasts until the title transfers out of state. Here, you don't have a strict three-year limit, but you'll need to act quickly before the state sells the property to someone else.

If the title transfers, you lose your right to redeem. The statutory redemption process kicks off right after the tax sale, allowing interested parties to make their claims.

If you miss the statutory period, you may still have a chance through judicial redemption, but this involves court proceedings and may extend indefinitely as long as you maintain minimal possession. The redemption window for properties sold to third parties closes upon transfer of title, so be proactive to avoid losing your rights!

Properties Not Sold at Auction

In Alabama, properties that don't sell at a tax lien auction are transferred to the State Department of Revenue, making them available for direct purchase. You can find these properties listed by the State's Property Tax Division, which includes details like property descriptions, locations, and the total amount due for purchase. To buy one of these properties, you'll need to complete an application with the State Department of Revenue. If the property is still within the three-year redemption period, you'll obtain a "Sale Certificate" from the county's Revenue Commission. After the redemption period expires, you'll receive a "Tax Deed" instead. It's important to note that unsold tax liens can be purchased over-the-counter at the Revenue Commission office, with a minimum purchase amount that includes all taxes, interest, penalties, and fees. Before you commit to a purchase, it's essential to verify the property's status and availability. Investigate every aspect, including any potential liens or title issues, and consider consulting a legal expert to navigate complexities.

Post-Sale Title Considerations

Navigating post-sale title considerations is crucial after purchasing tax delinquent property in Alabama.

First, understand that title companies are often wary of insuring tax titles due to potential issues, including unclear redemption rights. To secure title insurance, you'll need to resolve all title problems, typically through a recorded transfer or a quiet title order. If you obtain a quitclaim deed from someone with redemption rights, it can help clear the title.

Remember, quiet title relief generally requires you to possess the property for at least three years. If you haven't met this requirement, title companies may deny insurance, even with a quiet title order. However, adverse possession for three years can eliminate redemption rights, supporting your case for title insurance. Additionally, be aware that a tax lien creates a legal claim against the property you purchased, which could complicate your ownership if not addressed promptly.

After the tax sale, the probate court must confirm the sale within ten days. If you're the high bidder, ensure you obtain the certificate of purchase once confirmed.

To secure your investment, demand possession of the property and be prepared to initiate eviction proceedings if the original owner doesn't vacate within six months. Taking these steps helps establish a clear title and protects your investment.

Frequently Asked Questions

Can I Buy Tax Delinquent Property Online?

Yes, you can buy tax delinquent property online.

You'll need to register through GovEase, which manages the online auction process. Make sure you get approved before you bid.

Auctions happen annually, and you can participate by placing bids through their website.

Keep an eye on the auction dates and listings, and remember, after winning, you won't receive clear title immediately, so consulting an attorney might be a good idea.

What Happens if I Win but Can't Pay?

If you win a tax lien auction but can't pay, you'll lose your investment.

Typically, there's no refund for what you've paid, and you might still owe additional fees.

The lien could be re-auctioned, allowing another buyer a chance.

You may face legal action for not complying with the auction terms, and your credit score might take a hit.

It's crucial to understand the risks before participating in such auctions.

Are There Any Hidden Fees After Purchase?

Yes, there are potential hidden fees after you purchase.

You might face additional property taxes during the redemption period, and you'll need to cover any outstanding taxes or fees not included in the initial sale.

Legal costs for title searches or disputes could arise, and maintenance expenses for neglected properties can add up quickly.

It's wise to budget for these ongoing costs to avoid surprises down the line.

Always investigate thoroughly before making a purchase.

Can I Live in the Property Immediately?

You can't live in the property immediately after purchasing a tax lien or deed.

You'll need to wait until the redemption period expires and you've legally obtained possession. The property owner has time to pay off their delinquent taxes, and you must follow specific legal processes to demand possession.

If they refuse to vacate, eviction proceedings may be necessary, which can take additional time. Always check local laws for specific regulations.

How Do I Find Tax Delinquent Properties?

To find tax delinquent properties, start by checking state and county websites, which list auctioned properties.

Look at local county tax collector sites for upcoming tax lien auctions.

You'll often find property details in PDF forms, including owner names and bid amounts.

Utilize tools like Parcel Fair for consolidated data across counties, filtering properties by delinquency status, and use GIS maps for a visual layout of potential investments.

Conclusion

Buying tax delinquent property in Alabama can be a rewarding investment if you know the process. By understanding the steps—from preparing for the sale to navigating the bidding process—you'll be well-equipped to make informed decisions. Remember to consider the redemption period and post-sale title issues to protect your investment. With the right preparation and knowledge, you can seize opportunities in Alabama's real estate market and potentially secure a valuable property at a fraction of its worth.