Did you know property taxes are key for local government funding in Contra Costa County? They make up more than 70% of their revenue. It’s very important to understand how your property tax is worked out. This includes your payment duties in California. With a tax rate of about 1.3% of your home’s value, knowing the property tax details in Contra Costa can help you avoid surprise costs and penalties1

This guide makes property tax info easier to grasp. It covers how taxes are figured, when they need to be paid, and the ways you can pay them. Learning about property taxes means you can handle your financial duties without unexpected troubles. This allows you to focus on the more important parts of your life.

Key Takeaways

- Property taxes are a major source of income for local governments in Contra Costa County.

- The current property tax rate is about 1.3% of assessed value, as per California state law.

- Knowing your property tax bill can aid in effective financial management.

- Late payments can lead to penalties, so it’s crucial to pay on time.

- Tax exemptions and reductions are available that could lessen your tax burden.

What Are Property Taxes?

Property taxes are key for homeowners and residents. They are charges from local governments on property owners. This money is crucial for local services and community infrastructure. It shows how property taxes help support vital services.

Definition and Purpose

The definition of property taxes is the money charged based on property ownership. The main purpose of property taxes is to fund local government. This funding is vital to improving community life. In Contra Costa County, these taxes support education, public safety, and more. They usually begin at 1% and are divided among several agencies. This ensures local services run smoothly for everyone’s benefit2.

Importance of Property Taxes

Property taxes do more than just collect money; they fund crucial local services. These taxes support schools, parks, and emergency services. They are key to the well-being of communities. In Contra Costa County, with a tax rate of 1.36%, the impact is larger than in many places. This rate is above the U.S. and California averages. Here, the average property tax bill is about $6,706, way above the U.S. average. This underlines the significant role of property taxes in funding local government3.

| City | Median Property Tax Bill | Property Tax Rate |

|---|---|---|

| Diablo | $23,253 | Varies |

| Canyon | $3,003 | Varies |

| Port Costa | Varies | 1.95% |

| Knightsen | Varies | 1.08% |

How is Your Contra Costa County Property Tax Calculated?

Understanding how your property tax is figured out can make budgeting easier. In Contra Costa County, your property’s assessed value is what your taxes are based on. This value helps determine a tax rate for your property.

Assessed Value and Tax Rate

The assessed value is where it all starts when figuring out your taxes. The Contra Costa County Assessor’s Office checks your property to find this value. The usual tax rate for homes here is about 1% but can add on extra for local needs or bonds. This might go from just over 1% to 1.25% based on your city’s rules4.

This leads to an average tax rate in Contra Costa County of 0.95%. This is less than what some other places charge, like Riverside which is at 1.04%5.

Components of Your Tax Bill

Your property tax bill includes a few key parts. The main part is the ad valorem tax, which is most of what you pay. You might also pay extra for community projects, like schools or roads4. Plus, any late fees or other charges will show up on your bill.

It’s a good idea to look closely at your bill. This way, you can see each thing you’re paying for. This includes any extra charges that may impact your budget5.

When Are Property Taxes Due in Contra Costa County?

It’s crucial to know when to pay your property taxes in Contra Costa County. This knowledge saves you from late fees and keeps you in the county’s good graces.

Tax Payment Schedule

In Contra Costa County, property tax is split into two parts. The . By December 10, it’s important to have paid this installment to avoid penalties6.

The . Missed payments after April 10 result in a 10% penalty on the amount due6.

Here’s a quick overview of the key dates:

| Installment | Due Date | Delinquency Date | Penalty |

|---|---|---|---|

| First Installment | November 1 | December 10 | 1.5% per month on Unsecured Property Taxes |

| Second Installment | February 1 | April 10 | 10% on unpaid balance |

Remembering these delinquency dates prevents financial hassle and makes dealing with property taxes easier. Marking these dates in your calendar helps dodge penalties.

“Missing the April 1 deadline for the annual business property statement leads to a 10% late fee if not submitted by May 7.”7

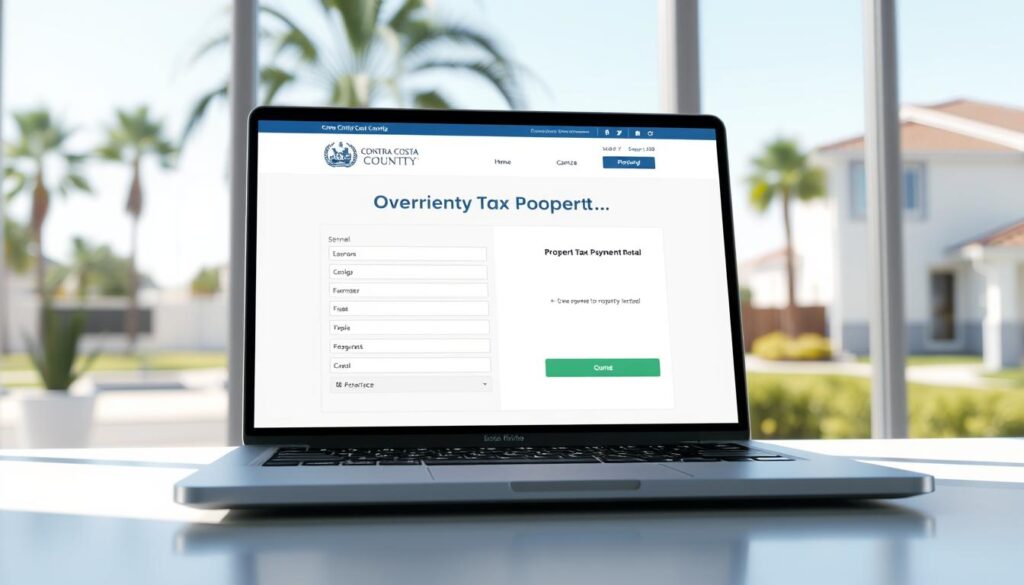

Making Property Tax Payments

Dealing with your Contra Costa County property tax is easy if you know how. The online tax payment portal makes it simple to pay from anywhere. You can pay with credit or debit cards using convenience payment methods.

Online Payment Options

With the Contra Costa online property tax payment system, you avoid the hassle of mailing checks. Note that Contra Costa County doesn’t allow partial payments8. Use this secure platform to keep away from late fees and more serious penalties. If paying by check, make sure to use the return envelope provided. Don’t mail cash8.

Payment Arrangements

If full payments are tough, look into different plans. It’s wise to contact the Contra Costa County Treasurer-Tax Collector’s Office. They can offer plans to make things easier and might provide tax penalty relief. Always double-check with your title or mortgage company first to avoid paying twice8.

For check payments, don’t forget to include your name, property address, and 10-digit APN for secured bills or account number for unsecured ones8. Make sure your check matches what you owe. Incorrect amounts may cause your payment to be sent back8.

| Payment Method | Details |

|---|---|

| Online Payments | Fast, secure, and convenient. Accepts credit and debit cards. |

| Mail-In Payments | Checks only, must include necessary billing details. Use provided return envelope. |

| Payment Arrangements | Contact Treasurer-Tax Collector’s Office for installment plans and relief options. |

Understanding Special and Supplemental Taxes

Special and supplemental taxes are key parts of your California property tax. Knowing about them helps you plan and manage money better. They include charges for public improvements and shifts in property value.

What Are Special Assessments?

Special assessments are extra fees for funding local projects and improvements. These fees come from benefits to your property, like better roads or services. The cost is based on these benefits and affects your total property taxes.

Not paying these fees can lead to penalties. It’s important to know about any special assessments. This knowledge helps you budget for your property tax costs.

Supplemental Tax Bills Explained

Supplemental tax bills come with changes in property ownership or upgrades. The County Assessor recalculates your property’s value. This bill shows taxes due on the new value for the rest of the fiscal year.

You might get multiple supplemental bills after buying property or making big improvements. Being ready for these bills stops tax increases from surprising you. Knowing what triggers these bills helps you manage your money and keep up with property tax payments.

Properties in tax-default for five years may be auctioned. Staying up to date with your tax payments is crucial. Understanding tax-defaulted property rules is key to following tax assessments. You’ll deal with different tax bills for real estate and personal property. Knowing these details helps you understand potential charges.

Remember, correcting tax issues can take up to two weeks. Quick action is important when fixing property tax problems910.

Conclusion

It’s key to understand your Contra Costa property tax details as a homeowner. Learning how your property’s market value affects taxes is important. This value is set by the county assessor11.

California’s Proposition 13 caps the property tax rate at 1% of this value. This cap helps protect you from huge financial hits if property values jump11.

Knowing key dates is crucial, like the first installment due on November 1. And the second due on February 1. This helps you dodge penalties and manage your money better11.

You could lower your tax bill with exemptions for homeowners and seniors. These breaks are for primary homes and eligible older adults11.

Being part of your community and understanding property taxes is empowering. It helps you take an active role in local decisions. And it’s useful if you need to navigate tax payment issues, like getting a Bond Against Taxes12.

This knowledge allows you to handle your property taxes confidently. It also supports community wellness12.

FAQ

What is the property tax rate in Contra Costa County?

How can I pay my property taxes in Contra Costa County?

What happens if I miss the property tax payment deadline?

What are special assessments in property taxes?

How do supplemental tax bills work?

Can I set up a payment plan for my property taxes?

Where can I find more information about property taxes in Contra Costa County?

Source Links

- Property Tax | Contra Costa County, CA Official Website – https://www.contracosta.ca.gov/6545/Property-Tax

- Where Your Property Tax Dollars Go – https://www.contracosta.ca.gov/6581/Where-Your-Taxes-Go

- Contra Costa County Property Taxes – Ownwell – https://www.ownwell.com/trends/california/contra-costa-county

- How Much Are Property Taxes in Contra Costa County, California? – https://bpfund.com/property-taxes-in-contra-costa-county/

- California Property Tax Calculator – SmartAsset – https://smartasset.com/taxes/california-property-tax-calculator

- FAQs • When are secured property taxes due? – https://www.contracosta.ca.gov/FAQ.aspx?QID=117

- Important Tax Dates | Contra Costa County, CA Official Website – https://www.contracosta.ca.gov/7586/Important-Tax-Dates

- Pay by Mail | Contra Costa County, CA Official Website – https://www.contracosta.ca.gov/598/Pay-By-Mail

- FAQs • What are Special Assessments? – https://www.contracosta.ca.gov/Faq.aspx?QID=125

- General Property Tax Questions | Contra Costa County, CA Official Website – https://www.contracosta.ca.gov/6569/General-Tax

- county of contra costa property tax – https://www.rlovearts.ca/teksxem/county-of-contra-costa-property-tax

- Understanding the Contra Costa County, CA Bond Against Taxes: What You Need to Know – Surety Bonds by Axcess – https://axcess-surety.com/understanding-the-contra-costa-county-ca-bond-against-taxes-what-you-need-to-know/