To report identity theft to the IRS, gather any suspicious notices or tax documents, then quickly file IRS Form 14039, the Identity Theft Affidavit, either online or by mail. Provide your Social Security number and explain your situation clearly. You should also contact the IRS Identity Protection Specialized Unit at 1-800-908-4490 and consider additional steps like filing a police report and monitoring your credit. Keep following for more tips to protect yourself.

Key Takeaways

- Contact the IRS Identity Protection Specialized Unit at 1-800-908-4490 to report the theft promptly.

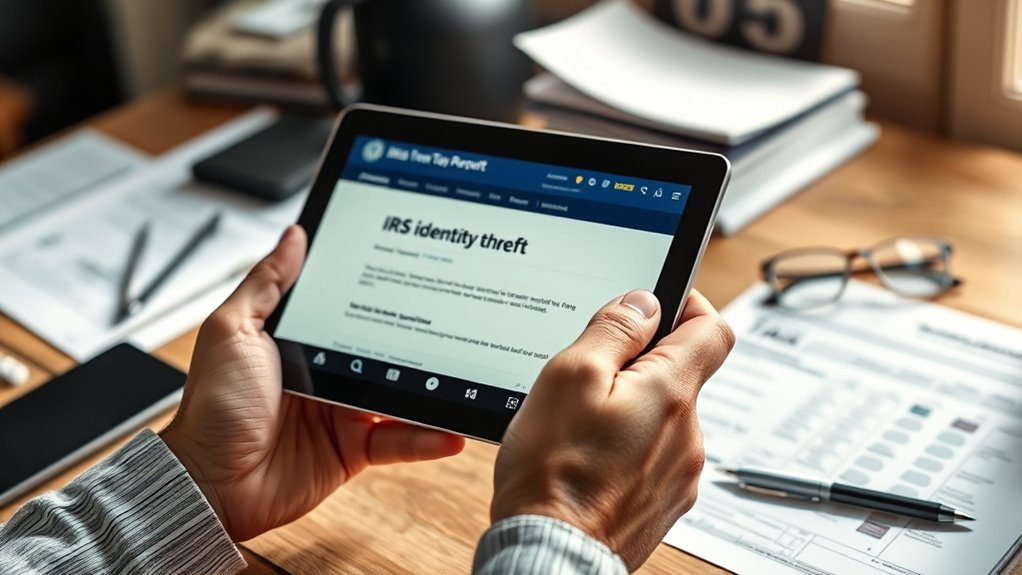

- Complete and submit IRS Form 14039 online or by mail to alert the IRS of identity theft.

- Gather and provide supporting documents such as copies of suspicious tax returns or notices.

- File a police report and notify banks or credit bureaus to document the theft and prevent further fraud.

- Monitor your credit report regularly and place fraud alerts or credit freezes to safeguard your identity.

If you suspect that someone has used your personal information to file a fraudulent tax return, it’s essential to act quickly. Tax refund fraud is a common tactic among identity thieves, and catching it early can prevent further damage. Typically, you’ll notice signs of this scam when the IRS contacts you about a duplicate return or when you try to e-file and receive an error message indicating that a return has already been filed under your Social Security number. These are clear indicators that someone else has submitted fraudulent tax returns using your information. Ignoring these signs can lead to delays in your legitimate refund and complicate resolving your case later.

If you notice a duplicate tax return or an error message when e-filing, act quickly to prevent fraud.

Your first step should be to gather all relevant documentation and details about the suspicious activity. When reporting tax refund fraud, you’ll want to contact the IRS immediately through their dedicated identity theft hotline. You can call the IRS Identity Protection Specialized Unit at 1-800-908-4490. Be prepared to provide your personal details, including your Social Security number, and explain the situation clearly. The IRS may ask for a copy of your tax return, notices you’ve received, or any communication that raises suspicion. If you receive a notice from the IRS about a discrepancy or notice of a tax return filed in your name, don’t ignore it—respond promptly.

Next, you should file IRS Form 14039, the Identity Theft Affidavit. This form officially notifies the IRS that you are a victim of identity theft and helps initiate the process to secure your account and prevent further fraudulent activity. Submitting this form can be done online through the IRS website or by mailing a paper copy. Once the IRS receives your form, they will place a marker on your account, which can help flag any future fraudulent activity and prevent the processing of fraudulent tax returns. Additionally, taking steps to monitor your credit regularly can help detect and prevent identity theft in other areas of your financial life.

In addition to reporting to the IRS, consider filing a police report. Identity theft is a crime, and having a police report can serve as evidence if you need to dispute fraudulent charges or resolve issues with financial institutions. Notify your bank, credit card companies, and credit bureaus to place fraud alerts or freeze your credit. This step is essential to prevent thieves from opening new accounts or obtaining credit in your name.

Frequently Asked Questions

How Long Does It Take for the IRS to Resolve Identity Theft Cases?

It usually takes the IRS about 180 days to resolve identity theft cases, but delays can happen, leading to tax refund delays. During this process, you should monitor your credit and consider credit monitoring services to protect your identity. Stay in contact with the IRS and provide any requested documentation promptly. Patience is key, as resolving theft issues can be complex and time-consuming, but your proactive steps help speed up recovery.

Can I Still File My Taxes if I Am a Victim?

Yes, you can still file your taxes if you’re a victim of identity theft. You should include a fraud alert on your credit reports and file IRS Form 14039, Identity Theft Affidavit. When you file, the IRS will flag your return to prevent a fraudulent refund. Be aware that your tax refund might be delayed, but reporting the theft helps safeguard your account and ensures you receive your rightful refund.

What Should I Do if I Suspect Someone Is Using My SSN?

If you suspect someone is using your SSN, act quickly by placing a credit freeze to prevent new accounts. Check your tax refund status for any suspicious activity and report it to the IRS immediately. You should also file a fraud alert with credit bureaus and consider filing a police report. Taking these steps assists in safeguarding your identity and ensures your tax refund isn’t stolen or misused.

How Can I Prevent Future Identity Theft Related to Taxes?

Imagine safeguarding your financial story—start by monitoring your credit regularly to catch any surprises early. Strengthen your defenses with secure credentials, like strong, unique passwords and two-factor authentication. Be cautious with sharing personal info and stay vigilant for suspicious activity. These simple, proactive steps help protect your identity from future tax-related theft, giving you peace of mind and control over your financial journey.

Are There Any Fees Associated With Reporting Identity Theft to the IRS?

There are no fees to report identity theft to the IRS. By doing so, you help prevent costly penalties and support fraud detection efforts. Reporting promptly guarantees that your stolen identity doesn’t lead to fraudulent refunds or tax liabilities. You can file a report online or contact the IRS directly. Taking swift action protects your taxes and helps authorities catch fraudsters, reducing potential financial and legal consequences.

Conclusion

Remember, acting quickly is key—identity theft can lead to serious tax issues. The IRS reports that over 300,000 taxpayers each year fall victim to identity theft, highlighting how common this problem is. By promptly reporting the theft and following the right steps, you can protect your finances and restore your peace of mind. Don’t wait—take action as soon as you notice suspicious activity to keep your tax information safe and secure.