Understanding payroll tax compliance isn’t just a task for accountants or HR managers; it directly impacts your livelihood and the employees who rely on you. Every dollar that’s incorrectly managed can lead to potential repercussions not only for your business but also for the hardworking individuals supporting their families through their earnings. A misstep in compliance can snowball into hefty fines, penalties, and even costly lawsuits, such as the one resulting in a $13.2 million loss for Alabama steelworkers in 20221. Whether you’re a small business owner or the leader of a large corporation, grasping the nuances of payroll management, tax liabilities, and the obligations that rest on your shoulders is crucial. This guide will walk you through everything you need to ensure your business remains compliant with payroll tax laws in the United States.

From understanding the types of payroll taxes to identifying employer and employee responsibilities, each section aims to provide you with the clarity you need. As you delve deeper into the content, realize that staying compliant not only protects your business but fosters trust and security among your team, ensuring everyone gets paid correctly and on time.

Key Takeaways

- Payroll tax compliance is essential for avoiding fines and legal actions.

- Both employers and employees have specific responsibilities related to payroll taxes.

- Miscalculations or late filings can lead to significant penalties.

- Pursuing accurate payroll management protects your business and employees alike.

- Regular updates to payroll practices are necessary due to changing laws.

What is Payroll Tax?

Payroll tax consists of mandatory deductions taken from employee wages intended to fund various government programs. You should understand its definitions and types, as these directly affect your financial obligations as an employer or employee. Comprising mainly of federal income tax and other tax contributions, payroll tax plays a significant role in shaping the economy.

Definition of Payroll Tax

Payroll taxes are collected from both employees and employers. These taxes contribute to government revenue, accounting for approximately 24.8 percent of combined federal, state, and local government funds2. Employers withhold portions of their employees’ paychecks to cover payroll deductions, which typically include Social Security and Medicare taxes. Specifically, the combined rate for these taxes amounts to 15.3 percent, with employers contributing 7.65 percent, while the other half is deducted from employees’ wages23.

Types of Payroll Taxes

Several categories of payroll taxes exist, which include:

- Federal income tax — withheld based on the employee’s W-4 form and applicable withholding tables3.

- Social Security tax — subjected to a wage ceiling of $132,900, affecting higher earners directly2.

- Medicare tax — applied universally to all wage and salary income at a rate of 2.9 percent, unlike the capped Social Security tax2.

- State income tax — varies by state and often encompasses both employers and employee contributions.

- Federal Unemployment Tax Act (FUTA) — specifically imposed on employers and not deducted from employee salaries3.

Understanding these components is essential, as they dictate how much is deducted from your pay and the responsibility shared between employers and employees.

Importance of Payroll Tax Compliance

Understanding payroll tax compliance is crucial for every business. Failure to adhere to regulations can lead to severe consequences, while maintaining compliance offers various advantages. Being aware of these critical aspects helps ensure your organization operates smoothly and avoids unnecessary risks.

Consequences of Non-Compliance

Non-compliance with payroll tax regulations can have significant repercussions for your business. The IRS may impose penalties that can reach up to 5% of the amount owed, depending on the severity of the tax liability4. In extreme cases, decision-makers may even face criminal charges for willfully ignoring payroll laws, resulting in personal financial penalties4. Organizations may also incur substantial back payment obligations to employees if wages are incorrectly withheld or miscalculated4. Maintaining proper payroll compliance not only helps in avoiding these penalties but also protects the reputation of your organization.

Benefits of Staying Compliant

Emphasizing payroll compliance within your business comes with numerous benefits. Organizations that follow the Federal Insurance Contributions Act (FICA) and the Federal Unemployment Tax Act (FUTA) help ensure funding for Social Security, Medicare, and unemployment benefits, promoting worker security5. Furthermore, staying compliant avoids legal issues and fosters a sense of trust and satisfaction among employees, who feel secure in their financial matters. Maintaining comprehensive payroll compliance systems is essential and should incorporate ample time for the preparation of reports and forms, along with reminders to file and pay on time4.

Who is Responsible for Payroll Tax?

Understanding the roles of both employers and employees in payroll tax compliance is crucial for effective payroll management. Each party has distinct responsibilities that ensure accurate administration of payroll taxes, which aids in maintaining compliance with federal regulations.

Employer Responsibilities

Employers have several key responsibilities regarding payroll tax compliance. They must accurately calculate, withhold, report, and remit the necessary amounts to the government. This includes the collection of Social Security and Medicare taxes, which together amount to 15.3% of employee wages, including both employer and employee contributions67. The Social Security tax itself is set at 6.2%, while the Medicare tax is 1.45%, and does not cap at an income limit87.

Employers are responsible for maintaining accurate employee records and providing all necessary documentation, such as Forms W-2. They must ensure timely payment of Federal Unemployment Tax Act (FUTA) contributions, which is 6% on the first $7,000 paid to an employee8. Failing to comply with these obligations can lead to severe penalties, including fines and interest8.

Employee Responsibilities

Employees also play a pivotal role in payroll tax compliance. Their primary responsibility involves providing accurate information on tax forms like the W-4, which helps employers correctly withhold taxes from their wages. Employees should be aware that they are liable for the additional Medicare tax of 0.9% if their earnings exceed $200,00067. Failure to report and accurately fill out such forms can disrupt the smooth functioning of payroll management.

By understanding and fulfilling their respective responsibilities, both employers and employees can contribute to a stable and compliant payroll system.

| Responsibilities | Employers | Employees |

|---|---|---|

| Calculate Payroll Taxes | Yes | No |

| Accurate Reporting | Yes | No |

| Withholding Taxes | Yes | Yes (provide accurate info) |

| Filing Tax Forms | Yes | Yes (form W-4) |

| Timely Payments to Government | Yes | No |

Being aware of these obligations can significantly reduce errors in payroll processes and foster a compliant work environment7.

How to Calculate Payroll Tax

Understanding how to accurately calculate payroll tax is essential for compliance and financial health. This process involves two key components: employee wage setup and tax rate determination. By leveraging effective payroll software, you can streamline these tasks, ensuring precise tax calculations and smooth payroll processing.

Employee Wage Setup

Setting up employee wages correctly is foundational in payroll tax calculations. It includes determining the employee’s classification, wage rate, and hours worked. For accurate calculation of Social Security taxes, use the formula: Employee Income × 6.2% = Social Security Tax9. Similarly, Medicare tax can be calculated using: Employee Income × 1.45% = Medicare Tax9. Remember, employers match these contributions, leading to a total employee contribution for FICA tax of 7.65%10. Properly gathering this data ensures effective payroll processing.

Tax Rate Determination

Various tax rates apply on wages depending on federal, state, and local regulations. The FICA tax rate of 7.65% is split equally between employees and employers. It’s worth noting that for the year 2025, the Social Security wage base will be $176,100, an increase from $168,600 in 202410. Employers are responsible for federal unemployment taxes (FUTA) paid entirely by them as well as state unemployment taxes (SUTA)9. These considerations are crucial for determining accurate payroll tax obligations.

Utilizing software can significantly ease the burden of keeping up with changing tax rates and regulations. It can automate many aspects of payroll processing, reducing the likelihood of errors associated with manual entries.

Payroll Tax Deductions Overview

Understanding payroll tax deductions is crucial for both employers and employees. These deductions encompass various taxes withheld from wages to meet federal and state regulations. Awareness of the different types of deductions allows for precise payroll processing and compliance with tax reporting requirements.

Federal Payroll Tax Deductions

Federal payroll tax deductions typically include Social Security, Medicare, and federal income tax. For 2024, the Social Security tax rate is 6.20%, and the Medicare tax rate is 1.45%, leading to a total payroll taxes rate of 7.65% for employees1112,). When an employee earns $1,000, they face a total payroll taxes deduction of $76.50. This comprises $62.00 for Social Security and $14.50 for Medicare1112,). It’s important to note that federal income tax withholding varies significantly based on withholding allowances. For a single earner claiming zero allowances, the federal income tax withheld can amount to $61, while claiming one allowance reduces it to $49, and claiming two allows for $3811.

State and Local Payroll Tax Deductions

State tax rates add another layer of complexity to payroll tax calculations. These deductions vary widely across jurisdictions and often include state income tax and additional local taxes. Employers need to stay informed about the specific state tax rates applicable in their areas, as mandatory deductions may include local income taxes, as well as unemployment insurance and other state-mandated coverage. Employees must also be aware that certain mandatory deductions may arise from court-ordered garnishments, which can affect their net pay13.

Reporting Payroll Taxes

Understanding the intricacies of payroll reporting is crucial for any employer. You need to be aware of the required forms to maintain compliance and know the filing deadlines to avoid penalties.

Required Forms for Payroll Reporting

Employers are required to report wages and compensation by filing essential forms with the IRS. Key forms include:

- Form 941: Quarterly report for federal income tax, Social Security, and Medicare taxes.

- Form W-2: For reporting annual wages paid to employees.

- Form 940: For reporting Federal Unemployment Tax (FUTA).

- Form 943: For agricultural employees.

- Form 944: For small businesses with less than $1,000 in annual tax liability.

- Form 945: For federal income tax withheld from non-payroll payments.

Filing these required forms accurately and on time is essential. Employers must submit Forms W-2 by January 31 for the previous year’s wages, while Forms 941 must be filed quarterly; failure to comply can lead to penalties1415.

Reporting Deadlines

Meeting filing deadlines is vital for payroll tax compliance. Employers must be mindful of specific due dates for each form:

| Form | Filing Frequency | Due Date |

|---|---|---|

| Form 941 | Quarterly | Last day of the month following the end of the quarter |

| Form W-2 | Annually | January 31 |

| Form 940 | Annually | January 31 |

| Form 943 | Annually | January 31 |

| Form 944 | Annually | January 31 |

| Form 945 | Annually | January 31 |

Failure to file on time can result in late fees and noncompliance penalties1415. It is crucial to stay organized and adhere to these filing deadlines to ensure smooth payroll operations.

Key Payroll Tax Regulations

Understanding key payroll tax regulations is essential for maintaining payroll compliance. Among the most significant regulations are the Federal Insurance Contributions Act (FICA) and the Federal Unemployment Tax Act (FUTA). These laws set forth the requirements for the collection of taxes that fund essential social programs and unemployment benefits.

Federal Insurance Contributions Act (FICA)

FICA requires employers to withhold a percentage of their employees’ wages to fund Social Security and Medicare. This obligation is a crucial aspect of payroll regulations, as it ensures the sustainability of these critical programs. The current FICA contribution rate includes a 6.2% tax for Social Security and a 1.45% tax for Medicare, applied on employee earnings. Employers must match these contributions, effectively doubling their compliance responsibilities.

Federal Unemployment Tax Act (FUTA)

The FUTA governs the federal unemployment tax, which is used to provide unemployment benefits to eligible workers. Employers pay a FUTA tax rate of 6.0% on the first $7,000 of each employee’s wages. After taking credit for state unemployment taxes, the effective rate can drop to as low as 0.6%, which encourages compliance with state regulations regarding unemployment insurance.

Adhering to FICA and FUTA statutes is not just about meeting legal requirements. It plays a vital role in ensuring that both employees and employers contribute responsibly to the funding of programs that safeguard workers during times of need. Maintaining payroll compliance and accurately reporting these payroll taxes are crucial for every business.

Ensuring compliance with FICA and FUTA not only supports essential social programs but also protects your business from potential penalties associated with non-compliance. Striving for diligence in these areas contributes to a well-managed payroll system, fostering trust and stability in your workforce1617.

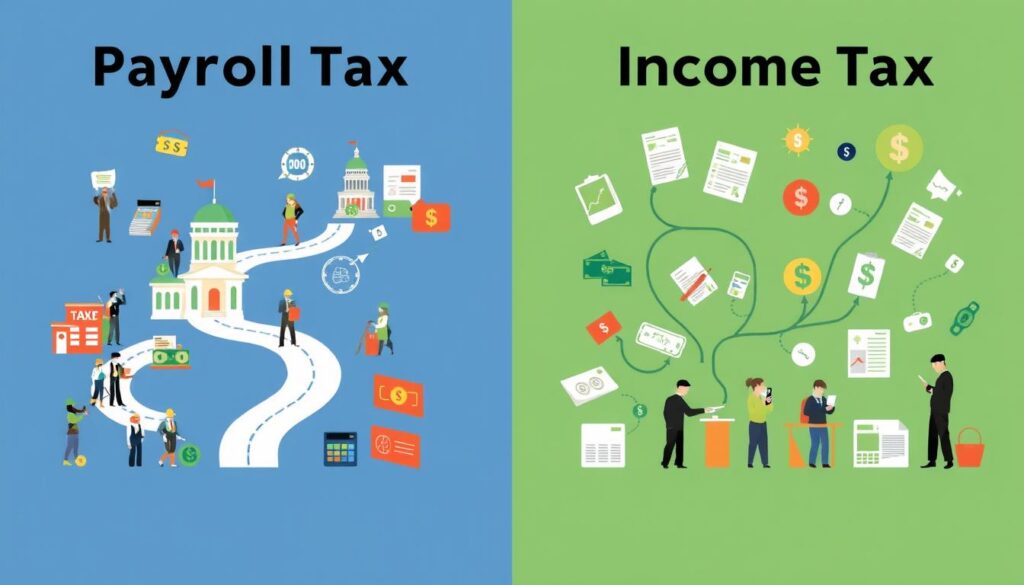

Differences Between Payroll Tax and Income Tax

Understanding the differences between payroll tax and income tax is crucial for employees and employers alike. While both contribute to government revenue, they serve distinct functions and apply different rates and regulations.

Definitions and Distinctions

Payroll tax primarily funds social programs like Social Security and Medicare, making it essential for economic stability. In 2024, the Social Security tax rate stood at 6.2% for wages up to $168,000, paid by both employee and employer18. Medicare tax is set at 1.45%, with an additional 0.9% applied to wages exceeding $200,00018. On the other hand, income tax is a broader tax system designed to generate general revenue for government operations, with rates ranging from 10% to 37%, depending on income levels19. While payroll taxes typically have a flat rate, income taxes operate on a progressive rate system, meaning that as income increases, so does the tax rate applied to that income19.

Impact on Employees

Employees often see both payroll tax and income tax deductions come from their paychecks. It’s important to recognize how these deductions affect overall take-home pay and annual tax liabilities during filing season. For instance, a typical scenario for an employee earning $15,000 annually would indicate a payroll tax deduction amounting to $1,147.50, while income tax calculations depend on personal circumstances declared on Form W-420. Both taxes serve significant roles, with payroll taxes directly supporting individual benefits and income taxes contributing to a wider array of public services19.

| Tax Type | Purpose | Rate Type | Typical Deductions |

|---|---|---|---|

| Payroll Tax | Funds Social Security and Medicare | Flat Rate | 6.2% Social Security; 1.45% Medicare |

| Income Tax | General government revenue | Progressive Rate | Varies (10%-37% based on income) |

Recognizing these differences allows you to manage your finances better and foresee any tax implications that come your way182019.

Payroll Tax and Employees

Understanding payroll tax and its implications is essential for any employer. Accurate withholding payroll taxes from employees’ wages is a legal requirement based on the information provided via their Form W-4. This compliance ensures correct tax calculations, fostering transparency and trust within the workplace.

Withholding Payroll Taxes

Employers must diligently manage the withholding payroll taxes from employees’ wages. The federal income tax, along with Social Security and Medicare taxes, significantly influences net pay. The total Social Security payroll tax is 12.4%, divided equally between the employee and employer, each contributing 6.2%12. Moreover, both parties contribute 1.45% for Medicare, with an additional 0.9% for employees earning over $200,00012 and20.

The responsibility for reporting these wages falls on employers, who must submit forms like Form 940 and Form 941 to the IRS3. Utilizing electronic funds transfers for federal tax deposits is mandatory, facilitating smooth compliance with tax obligations3.

Employee Notifications

Keeping employees informed through clear employee notifications about the taxes withheld from their salaries is crucial. This can be achieved by providing pay stubs that detail deductions, ensuring transparency in the process. Such notifications reinforce your commitment to payroll compliance while addressing any queries employees may have regarding their tax contributions.

Establishing a streamlined communication channel allows employers to explain the purpose of various taxes, like Social Security and Medicare, enhancing employee understanding and satisfaction with payroll processes. Adhering to these best practices not only promotes a positive work atmosphere but also helps in avoiding penalties related to payroll non-compliance.

Common Payroll Tax Mistakes to Avoid

Managing payroll taxes can be complicated, leading to critical payroll mistakes. It’s important to recognize the common pitfalls to avoid costly repercussions for your business. Primary mistakes often revolve around miscalculating deductions and filing late, which can compound penalties significantly.

Miscalculating Deductions

Miscalculating tax deductions can prove detrimental for any business. According to research, businesses using traditional payroll processes can experience a 20% error rate, with an average of 291 dollars spent on fixing each payroll mistake21. Failing to withhold the correct amount from employee wages results in underreporting or overreporting, which the IRS does not take lightly. Ignoring such errors can lead to significant tax penalties that could damage your company’s finances22.

Filing Late

Filing payroll tax reports late can impose heavy financial burdens. Businesses that fail to make timely payroll tax payments risk severe actions, such as the IRS seizing assets22. Moreover, ignoring IRS regulations can cost businesses thousands of dollars, causing frustrating delays and potential legal fees22. Keep in mind that 86% of Americans would feel a negative impact from just one missed or delayed paycheck, stressing the importance of payroll accuracy21.

State-Specific Payroll Tax Regulations

Understanding payroll tax regulations is crucial for employers as these rules can significantly differ from one state to another. Variations in tax rates, specific obligations, and additional taxes such as state unemployment taxes can impact your business operations. Staying informed about state regulations ensures your payroll tax compliance and helps you navigate the various state law resources effectively.

Overview of State Variations

Each state has unique payroll tax requirements that can affect your bottom line. For instance, the Social Security wage base for 2024 is set at $168,600, up from $142,800 the previous year23. The FICA tax rate remains at 7.65%, with Social Security accounting for 6.2% on wages up to this base, resulting in a maximum tax of $10,453.2023. The Federal Unemployment Tax Act (FUTA) imposes a 6% tax on the initial $7,000 of an employee’s wages, which can potentially reduce to 0.6% with state unemployment tax credits23. Furthermore, some states, including Alaska, Florida, and Texas, do not impose a state income tax, while nine states enforce a flat tax rate2425.

Resources for State Compliance

To ensure payroll tax compliance, employers can utilize various state law resources such as local labor departments and online platforms that specialize in payroll regulations. Accurate record-keeping is essential; inaccuracies can lead to a penalty of up to 10% for late deposits according to the IRS24. For example, in Alabama, companies must register for both a withholding account number and an unemployment compensation account number with their respective departments25. Knowing the specific requirements for your state can help you take advantage of available tax credits, ensuring your compliance is well-managed and you are maximizing potential savings.

Payroll Tax Audits

When preparing for payroll tax audits, you should know what to expect and how to get ready. These audits can arise at any moment, primarily initiated by the IRS or state entities, covering a typical scrutiny period of three years. That said, if employment tax returns are left unfiled, the IRS may go back even further, increasing your potential exposure. Understanding the nuances of audit preparation can help you minimize issues in these circumstances while ensuring compliance checks are always met.

What to Expect During an Audit

During an audit, you can anticipate a thorough examination of payroll records, tax returns, and supporting documentation. Common findings during these audits include inaccurately recorded employee information and improper classifications of workers. It’s vital to maintain precise records and be ready to showcase your compliance with all payroll tax regulations. The IRS employs various audit forms such as correspondence audits, office audits, and field audits, depending on the situation and severity of discrepancies found26.

Gathering necessary documentation is crucial, including payroll records, tax returns, bank account statements, and pay stubs to simplify the audit process. Remaining cooperative and accurate with information can expedite the proceedings and help resolve any issues promptly27.

How to Prepare for an Audit

Preparation is key when it comes to avoiding complications during payroll tax audits. It’s beneficial to keep organized records and to routinely conduct self-audits to uncover potential discrepancies ahead of time. Establishing a relationship with a tax professional or lawyer can provide significant assistance; they can help negotiate settlements, submit amended returns, or challenge audit findings when necessary. Additionally, you have the right to appeal any audit findings through a protest process, should these arise26. By proactively addressing any complications identified during the audit, you can set your business up for improved compliance and future success.

How to Handle Payroll Tax Issues

Addressing payroll tax issues promptly is vital for maintaining compliance and safeguarding your business. If payroll tax discrepancies arise, it is crucial to take immediate action. Ignoring these problems can lead to severe consequences, including penalties and legal actions initiated by the IRS.

Contacting the IRS

If you encounter payroll tax issues, reaching out to the IRS can provide clarity. The IRS can send agents to seize business assets if employee payroll taxes are not paid28. They actively pursue collection activities on common payroll tax problems, particularly those associated with Form 94129. It’s essential to understand that all business structures are equally responsible for paying employee payroll taxes28. Addressing these issues may involve clarifying your obligations or correcting mistakes. The IRS strictly enforces compliance and can issue escalating penalties for failures or delays in payroll tax payments28.

Seeking Professional Help

In many cases, seeking professional assistance can alleviate the complexities of payroll tax regulations. Engaging the services of tax advisors or payroll services is a wise decision to navigate potential challenges29. They can help ensure that necessary forms are filed on time and that payments are made in the correct amounts. Furthermore, consulting with an experienced Enrolled Agent can aid in negotiating with the IRS and potentially reduce assessed fines and penalties29. Disputes over payroll taxes often lead to additional expenses and may distract you from crucial business operations. Therefore, having the right professional guidance is key in handling any payroll tax issues successfully.

The Future of Payroll Taxes

As payroll tax legislation continuously evolves, staying updated on future trends is vital for effective business operations. Understanding these shifts will enable employers to adapt to changing requirements, which is essential for maintaining compliance while optimizing employee compensation structures. You need to consider how these legislative trends shape the payroll landscape and influence various business sectors.

Trends in Payroll Tax Legislation

Recent surveys indicate substantial changes in payroll strategies across organizations. A Global Payroll Survey revealed that 67% of companies have formalized payroll strategies in place30. Many organizations are facing compliance challenges, with 43% citing it as a primary payroll pain point30. Cloud-based technology is gaining traction, as 54% of respondents reported utilizing it for payroll processing30. On the employee front, 76% of those worried about their finances expressed interest in employers that prioritize their financial well-being30.

Implications for Employers and Employees

The implications of these changes for businesses are significant. They must review their payroll systems to integrate new requirements, such as the Social Security tax rate, which stands at 6.2% on the first $142,800 of earnings, and the Medicare tax, set at 1.45% on all earnings31. In preparing for these implications, it is crucial to understand that misclassification of employees as independent contractors can lead to severe penalties32. Moreover, companies can enhance their bottom line by implementing tax-exempt fringe benefits that alleviate the tax burden for both employers and employees32. Overall, the future trends in payroll tax legislation will require you to remain proactive in your strategies to ensure compliance alongside financial efficiency.

Helpful Resources for Payroll Tax Compliance

Staying informed about payroll tax compliance can feel overwhelming, but various resources are available to guide you in this process. Utilizing information from government websites and engaging with professional organizations can significantly enhance your understanding and management of payroll taxes.

Government Websites

You should regularly check government websites such as the IRS and state tax agencies for the latest updates on payroll tax regulations. The IRS has introduced several new initiatives, including the Third-Party Payer Supplemental Claim Program, announced on September 26, 202433. Beginning January 1, 2024, filers of at least 10 returns in a calendar year must electronically file information returns, such as Form 1099 series and Form W-233. These platforms provide essential information regarding tax rates, forms, and filing guidelines. Moreover, businesses can access resources related to employee retirement plans and the Earned Income Tax Credit (EITC), ensuring you and your employees are fully aware of your rights and options34.

Professional Organizations

Professional organizations focused on payroll and tax compliance offer a wealth of knowledge and networking opportunities. Participating in these organizations can help you enhance your payroll practices and stay updated on compliance requirements. They provide access to forums and workshops where you can discuss complex topics like payroll tax calculations and filing requirements. Additionally, you can learn about the importance of making federal tax deposits through electronic funds transfers, ensuring compliance with all payment timelines33.

Conclusion

Understanding payroll tax compliance is crucial for the sustainability and efficiency of your business. By ensuring you are aware of regulations and responsibilities related to payroll management, you position yourself to avoid costly mistakes and enhance operational effectiveness. Compliance not only safeguards your business from penalties but also contributes to the funding of essential programs like Social Security and Medicare, which support millions of Americans.

Summary of Key Takeaways

In summary, payroll taxes accounted for 30 percent of total federal revenues in 2022, making them the second-largest source of revenue for the government35. Employers and employees each contribute 7.65 percent in FICA taxes, which directly impact programs crucial to the economy35. Staying informed about the various regulations, from federal to state-specific obligations, ensures that you can manage payroll taxes effectively while maximizing your company’s financial health and workforce satisfaction.

Utilizing available resources and adhering to best practices can significantly simplify payroll tax compliance. As payroll management continues to evolve, being proactive in understanding key trends and obligations is imperative for any business aiming for long-term success.

FAQ

What are payroll taxes?

Why is payroll tax compliance important?

Who is responsible for payroll tax compliance?

How do I calculate payroll taxes?

What types of deductions are included in payroll taxes?

What forms are required for reporting payroll taxes?

What regulations affect payroll taxes?

How does payroll tax differ from income tax?

How can I avoid payroll tax mistakes?

What should I expect during a payroll tax audit?

What should I do if I have payroll tax issues?

Where can I find resources for payroll tax compliance?

Source Links

- https://www.paycom.com/resources/blog/payroll-compliance/ – Blog post >> Visit the Paycom blog to learn more

- https://taxfoundation.org/taxedu/glossary/payroll-tax/ – What is a Payroll Tax?

- https://www.irs.gov/businesses/small-businesses-self-employed/understanding-employment-taxes – Understanding employment taxes | Internal Revenue Service

- https://www.rippling.com/blog/payroll-compliance – Payroll Compliance 101: Guide & Best Practices | Rippling

- https://www.paylocity.com/resources/tax-compliance/payroll-compliance/ – Payroll Compliance Guide: Laws, Risks, & Best Practices

- https://www.patriotsoftware.com/blog/payroll/who-pays-payroll-taxes/ – Unraveling Payroll Tax Responsibility: Who Pays and Why

- https://www.wolterskluwer.com/en/expert-insights/employers-responsibility-for-fica-payroll-taxes – Employers’ Responsibility for FICA Payroll Taxes

- https://www.bamboohr.com/resources/hr-glossary/employer-payroll-taxes – Employer Payroll Taxes

- https://onpay.com/insights/how-to-calculate-payroll-taxes/ – How to calculate payroll taxes: Step-by-step instructions | OnPay

- https://www.patriotsoftware.com/blog/payroll/how-calculate-payroll-taxes-for-employers/ – How to Calculate Payroll Taxes | Detailed Guide with Examples

- https://files.consumerfinance.gov/f/documents/cfpb_building_block_activities_understanding-paycheck-deductions_handout.pdf – Understanding paycheck deductions

- https://www.investopedia.com/terms/p/payrolltax.asp – The Basics on Payroll Tax

- https://fam.state.gov/fam/04fah03/04fah030540.html – PAYROLL DEDUCTIONS AND CONTRIBUTIONS

- https://www.irs.gov/businesses/small-businesses-self-employed/depositing-and-reporting-employment-taxes – Depositing and reporting employment taxes

- https://www.wolterskluwer.com/en/expert-insights/understanding-payroll-tax-payment-and-filing-requirements – Understanding Payroll Tax Payment and Filing Requirements

- https://www.completepayroll.com/blog/payroll-and-tax-regulations-in-new-york – Navigating Payroll and Tax Regulations in New York: A Comprehensive Guide

- https://www.irs.gov/businesses/small-businesses-self-employed/employment-tax-due-dates – Employment tax due dates | Internal Revenue Service

- https://www.oysterhr.com/library/payroll-tax-vs-income-tax – Payroll tax vs. income tax: Understanding the differences | Oyster®

- https://www.sambrotman.com/blog/payroll-tax-vs-income-tax/ – Payroll Tax vs Income Tax: What’s the Difference Between Them? – Brotman Law – All Rights Reserved | 402 W Broadway, Suite 800 • San Diego, California 92101

- https://www.chase.com/business/knowledge-center/grow/payroll-vs-income-tax – What’s the difference between payroll and income taxes?

- https://www.paycom.com/resources/blog/common-payroll-mistakes/ – Blog post >> Visit the Paycom blog to learn more

- https://aghlc.com/resources/articles/2015/7-common-payroll-tax-mistakes-article-150416.aspx – 7 Common Payroll Tax Mistakes You Want to Avoid

- https://www.joinhomebase.com/blog/state-payroll-taxes – State Payroll Taxes: Everything You Need to Know in 2024

- https://blog.onesourcevirtual.com/resources/blog/payroll-tax-compliance-a-guide-to-federal-state-and-local-payroll-tax – Payroll Tax Compliance: A Guide to Federal, State, and Local Payroll Tax

- https://www.trinet.com/insights/state-by-state-payroll-tax-and-registration-guide – State by State Guide to Payroll Tax & Registration

- https://www.bragertaxlaw.com/payroll-tax-audits.html – Payroll Tax Audits | Los Angeles Payroll Tax Lawyer Dennis Brager

- https://damienslaw.com/what-do-i-do-if-i-receive-an-irs-payroll-tax-audit/ – What Do I Do If I Receive An IRS Payroll Tax Audit?

- https://aghlc.com/resources/articles/2014/8-tips-avoid-payroll-tax-issues-140915.aspx – 8 Tips for Avoiding Payroll Tax Issues

- https://www.myirstaxrelief.com/resources/solutions-to-tax-problems/how-to-deal-with-941-payroll-tax-problems/ – How to Deal With 941 Payroll Tax Problems

- https://tax.thomsonreuters.com/blog/future-of-payroll-survey-says-no-time-like-the-present-to-look-ahead-for-keeping-up-with-industry-trends/ – “Future of Payroll Survey” Says No Time Like the Present to Look Ahead for Keeping Up With Industry Trends

- https://edenredbenefits.com/payroll-taxes-how-employers-can-reduce-them-in-2024/ – Payroll Taxes: How Employers Can Reduce Them in 2024 – Edenred Benefits

- https://www.criadv.com/insight/payroll-taxes/ – Taking a Bite Out of Payroll Taxes | Carr, Riggs & Ingram

- https://www.irs.gov/businesses/small-businesses-self-employed/payroll-professionals-tax-center-information-for-payroll-professionals-and-their-clients – Payroll professionals tax center information for payroll professionals and their clients

- https://apspayroll.com/blog/payroll-taxes-explained/ – Payroll Taxes Explained: Essential Guide for Employers

- https://www.pgpf.org/article/budget-explainer-payroll-taxes/ – Payroll Taxes: What Are They and What Do They Fund?