Did you know 38 states in the US let local governments add their own sales taxes on top of the state’s? This fact changes how much you pay for things everywhere in the country1. Sales tax is a key part of taxes in the US. It’s a tax on what you buy, and it varies a lot depending on where you are2. In this article, we’ll talk about what sales tax is, why it’s important, how to figure it out, and how it changes what you pay for stuff and affects your money.

Key Takeaways

- Sales tax is imposed by individual states and local governments.

- 38 US states enforce local sales taxes in addition to state taxes.

- States like Delaware and Oregon do not levy any sales tax.

- Understanding how sales tax applies can impact your purchasing decisions.

- Local sales tax can significantly change the total cost of goods and services.

What is Sales Tax?

Sales tax is a key part of the tax system in the U.S. It’s basically a consumption tax. Knowing what sales tax definition means is crucial for both shoppers and business owners. It is added to the price of bought goods and services, figured as a percent of the purchase at checkout. This tax isn’t added at each sale of an item. Instead, it’s only for the final buyer, helping to bring in money for state and local government.

Definition and Overview

Sales tax’s purpose is to support government projects. It’s a tax that helps fund vital services like schools, health care, and road work. As of 20243, thirty-eight states in the U.S collect local sales taxes. Plus, people tend to shop in places with lower taxes to save money. This thinking greatly affects where companies decide to set up shop.

Purpose of Sales Tax

The main goal of sales tax is to help pay for state and local projects. The money raised from this tax goes to many public efforts, keeping community services going. In some areas, like Chicago4, sales tax can hit 10.25%. This is because of the added taxes from different government levels. Yet, states like Alaska and New Hampshire have no statewide sales tax at all. This shows how varied sales tax can be across the U.S3.

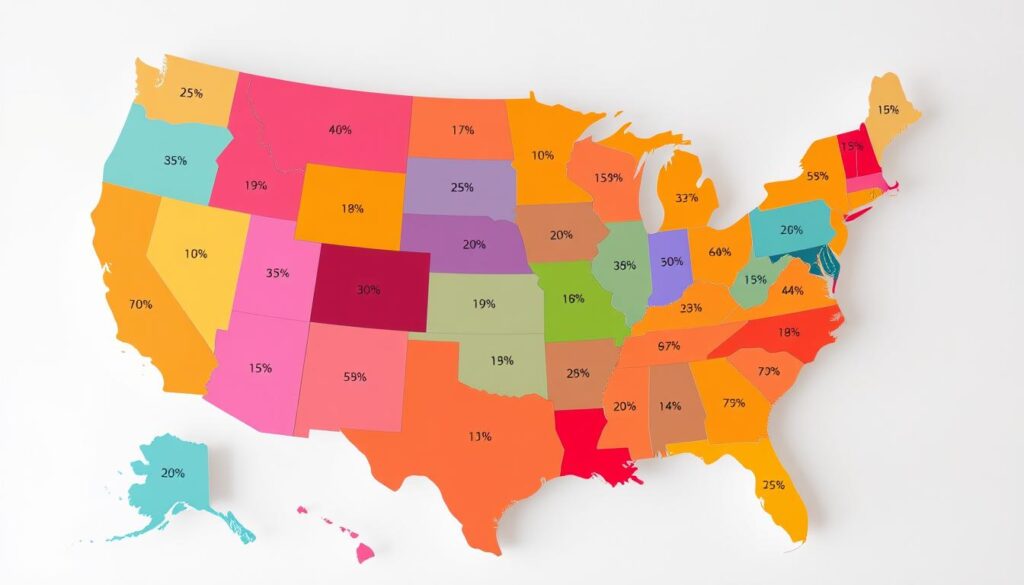

Sales Tax Varies by State

Understanding sales tax can help you better manage your finances. Every state has different sales tax rates. Let’s dive into how sales tax works and its impact on you.

General Sales Tax Overview

45 states, along with the District of Columbia, impose a statewide sales tax5. For example, California’s sales tax rate is 7.25 percent. States like Louisiana and Tennessee have the highest overall sales tax rates, over 9.5%5. This shows how combined state and local taxes can significantly increase the total sales tax rate.

States without Sales Tax

Imagine living in a place with no general sales tax. Alaska, Delaware, Montana, New Hampshire, and Oregon offer just that. Yet, local taxes may still apply in some areas of these states56.

Local Sales Tax Variations

Local taxes play a big role in your final tax bill. In 38 states, local governments add their own sales taxes5. For instance, Alabama’s base rate is 4.000%, but local taxes can add more6. Milwaukee’s recent tax increase shows how local taxes can vary greatly5.

How to Calculate Sales Tax

Learning how to calculate sales tax is key for budgeting well. You need to know your state’s tax rate as it impacts your costs significantly. The formula is simple: multiply the item’s price by the tax rate turned into a decimal. This makes figuring out the tax straightforward, helping you plan your expenses.

Understanding Tax Rates

In the U.S., 45 states and the District of Columbia charge a state sales tax. Only five states, like Alaska and New Hampshire, don’t7. Tax rates differ, with California’s being the highest at 7.25%, and some states close behind at 7%8. Local areas might charge more, especially for things like hotel or restaurant services7.

Calculation Example

Let’s look at how to calculate the sales tax. Imagine you’re buying a $10 book in a place with a 6% sales tax. Here’s how you do it:

- Identify the price: $10

- Get the tax rate: 0.06

- Use the sales tax formula: $10 x 0.06 = $0.60

So, you’ll pay:

- Total Cost = Price + Sales Tax = $10 + $0.60 = $10.60

This shows why knowing how to calculate sales tax matters for your budget7.

Remember, sales tax exemptions might lower your final cost based on local rules and what you’re buying8.

What is Nexus?

Nexus determines a business’s sales tax duties. Knowing different nexus types is key to follow state laws and manage taxes well. There are two main kinds: physical presence nexus and economic nexus. They impact how businesses handle sales tax issues.

Physical Presence Nexus

The idea of nexus used to focus on physical presence. This means a business must be tangibly linked to a state to owe sales tax. A company gets this link by having a location, workers, or big activities in the state. The Supreme Court changed the game with South Dakota v. Wayfair. It let states tax remote sellers more freely9.

Economic Nexus and Recent Changes

Economic nexus looks at a business’s economic actions in a state, not just physical presence. After South Dakota v. Wayfair, states got the green light to tax out-of-state shops. They must hit certain sales or transaction numbers910. Grasping these nexus laws is crucial due to state-by-state differences.

California and Colorado set their own sales limits for economic nexus10. California asks for $500,000 in sales, while Colorado’s limit is $100,000. These sales tax changes affect not just big businesses but also new entrepreneurs working across states.

Comparing Sales Tax and Use Tax

It’s crucial to know the difference between sales tax and use tax in the U.S. Sales tax is for purchases within a state. Use tax is for items bought outside but used within a state. Different rules apply based on where you buy.

Although the rates for both taxes are usually the same, how they’re enforced differs. This affects consumers in various ways.

Definitions and Differences

In the U.S., 45 states, including the District of Columbia, collect sales tax. Additionally, 38 of these states have local sales taxes too11. Knowing about use tax is key for online or out-of-state purchases. For instance, if you buy a car in Florida without sales tax, you must pay use tax in Georgia when you register it11. It’s important to understand your use tax duties.

Scenario Examples

Imagine buying a high-end laptop online from another state. If the seller doesn’t charge sales tax, you must pay the use tax yourself11. In California, use tax is required for items used, consumed, or stored within the state12. These examples show the differences between sales and use tax, stressing the importance of knowing the rules for your purchases.

| Feature | Sales Tax | Use Tax |

|---|---|---|

| Imposition | On in-state purchases | On out-of-state purchases used in-state |

| Enforcement | Generally collected at point of sale | Self-reported by the consumer |

| Tax Rate | Varies by state and locality | Typically the same as sales tax rate |

| Example Scenario | Buy a book in a local bookstore | Buy a car in another state |

| State Regulations | Specific to each state | May vary by state |

Understanding both sales and use tax helps with financial planning and following the law1112.

Types of Goods Subject to Sales Tax

Knowing what items are hit with sales tax can inform your buying choices. States vary in what they tax, creating a tricky situation. Learning about usual tax items and exceptions can help you save money.

Commonly Taxed Items

Goods like furniture, clothes, beauty products, and meals out often get taxed. The tax rate and taxable items differ by location. For example, Colorado taxes items you can touch, eat, drink, and some services but not wholesale purchases13.

In New York, certain services and items have special tax rules. There’s an extra 6% tax for shared car drivers, and a 20% extra tax on vapes14.

Exemptions and Special Cases

Tax exemptions are crucial for making necessary items more affordable. Common non-taxable items include groceries, prescription drugs, and educational stuff.

In New York, hotels have different tax rules. A $1.50 daily fee is added to New York City hotel stays, on top of regular sales tax. State taxes might also be charged on services like phone calls14.

Understanding sales tax details can help you plan your budget better. It lets you use exemptions to your advantage.

What is Excise Tax?

Excise tax is a special tax placed on certain products. These products are usually harmful to society. Things like alcohol, tobacco, and fuel often carry this tax. This tax might already be added to the price of the product. This is different from sales tax, which you see added when you buy something. In the U.S., excise taxes bring in about 4% of all tax money. This is less than the 12% average in other developed countries15.

Definition and Examples

The phrase excise tax definition means a tax on certain controlled goods. For example, the U.S. has excise taxes on gas, plane tickets, and cigarettes. The government charges a tax of $0.184 for each gallon of gas. This is a big part of the total excise taxes collected15. New York, for instance, charges $4.35 per pack of cigarettes, on top of a federal tax of $1.0116 and15. Beer producers also pay extra taxes, as do cruise ship operators16.

Comparison with Sales Tax

Knowing the difference between excise and sales tax is crucial. Excise tax is usually a fixed amount per unit, whereas sales tax is a percentage of the sale price. Sales tax can vary a lot – from 0% to 9.5%, based on where you are. Sometimes, both taxes are applied to things like alcohol or tobacco. This shows how complex tax rules can be. It’s important for businesses to handle both types of taxes well. This is especially true considering how the tax burden differs across income levels15.

Sales Tax vs. VAT Tax

Looking at sales tax and VAT, we see key differences. Sales tax is charged only at the final sale to the consumer. On the other hand, VAT is added at every step, from production to sale. This makes VAT more wide-reaching. Countries with VAT, like those in the European Union, often see bigger tax revenues over time17. Indeed, over 160 countries have adopted VAT. This shows its wide acceptance in global tax practices17.

Key Differences

The main differences between sales tax and VAT are how they’re collected. In a VAT system, every seller adds to the tax pot. But with sales tax, only the final buyer pays the tax18. VAT creates a steadier flow of money to governments. This is because it collects taxes at many points, not just from the buyer. Say a business sells goods without adding tax, they then owe a use tax for those sales18.

Global Perspectives on Consumption Tax

Different countries have their own way of managing taxes on goods and services. For example, the U.S. could gain an extra $150 billion a year by using VAT17. Many places have switched from sales tax to VAT, seeking to improve tax enforcement and increase revenue19. Interestingly, pushing sales tax rates over 10 percent often doesn’t work well. However, VAT’s way of collecting tax at each stage leads to better compliance19. This shows how important it is to understand VAT in other countries. It has a big impact on the global economy and how companies operate across borders.

Conclusion

Sales tax knowledge is crucial for both shoppers and businesses in America. This overview highlighted how sales tax varies in different states and its importance as a major source of income for state and local governments. Sales taxes make up 30.4% of all state tax revenues, making them second to individual income taxes at 37.7%20.

In states like Washington, sales tax systems can be quite different. Since 2008, Washington has used a destination-based sales tax. This method is key for local government funds but is challenging due to its regressive impact on low-income families2122.

Understanding sales tax is more important than ever. As people’s shopping changes and local economies shift, knowing about sales tax helps you make smarter buying choices. It also supports the revenue needs of local and state governments.

FAQ

What is the sales tax rate in the US?

How do I know if I need to pay sales tax on my purchases?

What is nexus and why is it important for sales tax?

Can I get a refund on sales tax if I return an item?

How does use tax differ from sales tax?

Which states do not impose a general sales tax?

What types of goods are commonly subject to sales tax?

Are there any common exemptions to sales tax?

What is the difference between excise tax and sales tax?

How do sales tax and VAT differ?

Source Links

- What is sales tax? – https://tax.thomsonreuters.com/blog/what-is-sales-tax/

- What Is Sales Tax? Definition, Examples, and How It’s Calculated – https://www.investopedia.com/terms/s/salestax.asp

- What is a Sales Tax? – https://taxfoundation.org/taxedu/glossary/sales-tax/

- Sales tax – https://en.wikipedia.org/wiki/Sales_tax

- State and Local Sales Tax Rates, 2024 – https://taxfoundation.org/data/all/state/2024-sales-taxes/

- State Sales Tax Rates – Sales Tax Institute – https://www.salestaxinstitute.com/resources/rates

- Sales Tax Calculator – https://www.calculatorsoup.com/calculators/financial/sales-tax-calculator.php

- How to Calculate Sales Tax, With Examples – https://www.investopedia.com/how-to-calculate-sales-tax-7113366

- What is Nexus? | Sales Tax Institute – https://www.salestaxinstitute.com/sales_tax_faqs/what_is_nexus

- A guide to nexus and sales tax nexus | Stripe – https://stripe.com/resources/more/nexus-tax-101

- Sales tax vs. use tax: the differences – https://tax.thomsonreuters.com/blog/sales-tax-vs-use-tax-the-differences/

- Tax Rate FAQ for Sales and Use Tax – https://www.cdtfa.ca.gov/taxes-and-fees/tax-rate-faq.htm

- Sales Tax Guide | Department of Revenue – https://tax.colorado.gov/sales-tax-guide

- Products, services, and transactions subject to sales tax – https://www.tax.ny.gov/bus/st/subject.htm

- What is Excise Tax and How Does it Differ from Sales Tax? – https://www.accuratetax.com/blog/what-is-excise-tax/

- Excise Tax: What It Is and How It Works, With Examples – https://www.investopedia.com/terms/e/excisetax.asp

- What Is Value-Added Tax (VAT)? – https://www.investopedia.com/terms/v/valueaddedtax.asp

- What is the difference between sales tax and VAT? – https://tax.thomsonreuters.com/blog/what-is-the-difference-between-sales-tax-and-vat/

- Why is the VAT administratively superior to a retail sales tax? – https://taxpolicycenter.org/briefing-book/why-vat-administratively-superior-retail-sales-tax

- Modernizing State Sales Taxes: A Policymaker’s Guide – https://taxfoundation.org/research/all/state/state-sales-tax-reform-guide/

- MRSC – Sales and Use Taxes – https://mrsc.org/explore-topics/finance/revenues/sales-taxes

- Report – https://dor.wa.gov/sites/default/files/2022-02/Chapter_4.pdf